BERLIN (Reuters) - Orders for German-made goods posted their sharpest slump in May since the first lockdown in 2020, data showed on Tuesday, hurt by weaker demand from countries outside the euro zone and fewer contracts for machinery and intermediate goods.

The data published by the Federal Statistics Office showed orders for industrial goods fell by 3.7% on the month in seasonally adjusted terms, marking the first drop in new business this year.

This confounded a Reuters forecast of a 1% rise and came after an upwardly revised increase of 1.2% in April.

A breakdown of the data showed that foreign demand fell by 6.7%, with orders from outside the euro zone tumbling 9.3%. Domestic demand rose by 0.9%.

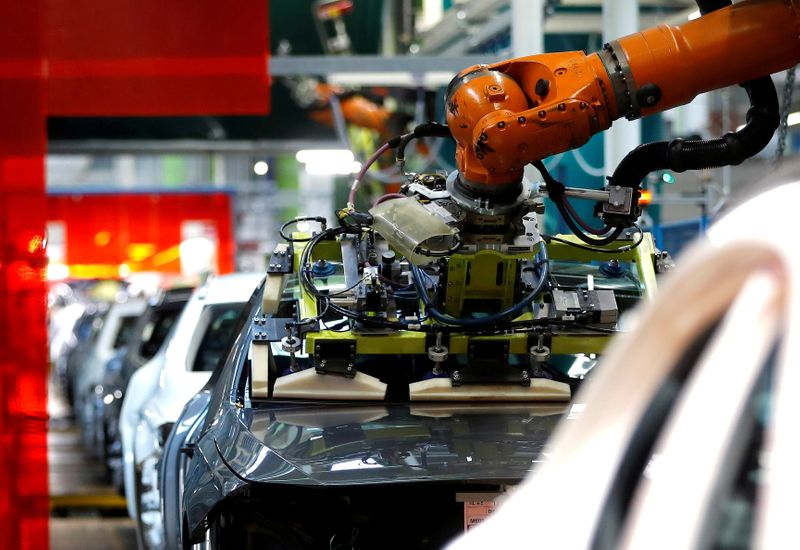

Demand for capital goods, such as machinery and vehicles, fell by 4.6% while orders for intermediate goods contracted by 3.6%, the data showed. Orders for consumer goods rose.

Thomas Gitzel, an economist at VP bank, said the decline suggests that a shortage of materials is leaving its mark on order intake.

"If companies are unable to process orders due to a lack of input materials, orders will not be placed at all," he said.

However, he noted it was also likely that strong pandemic demand for goods such as furniture and healthcare products - which had to be produced by German machinery - was also slowing down and would return to more normal levels.

The German economy contracted by 1.8% in the first quarter as lockdown restrictions in place since November dampened household spending and raw material shortages created manufacturing bottlenecks.

A relaxation of restrictions in the three months to the end of June is expected to have fuelled a recovery, and economists are forecasting growth for the summer despite supply bottlenecks crimping production of many industrial companies.