By Leika Kihara

(Reuters) - Group of Seven (G7) advanced economies will consider how best to help developing countries introduce central bank digital currencies (CBDC) consistent with appropriate international standards, Japan's top currency diplomat Masato Kanda said on Tuesday.

The move will be among key themes of G7 discussions that Japan chairs this year, as part of efforts to address challenges the global community face from fast-moving digital technology, he said.

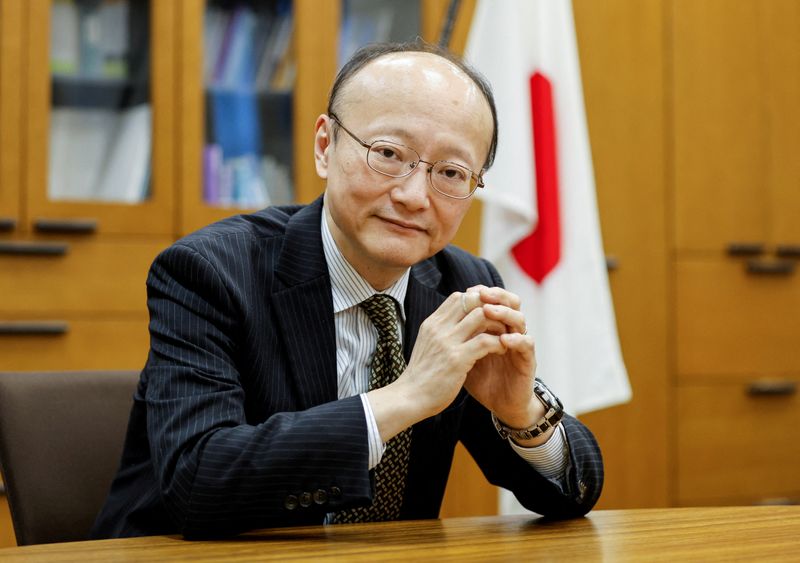

"We have to address risks from the development of CBDC by ensuring factors such as appropriate transparency and sound governance," Kanda, vice finance minister for international affairs, told a seminar in Washington.

"As a priority of this year, the G7 will consider how best to help developing countries introduce CBDC consistent with appropriate standards, including the G7 public policy principle for retail CBDC," he said.

Outside the G7, China has been leading the pack on issuing a digital currency. G7 central banks have set common standards toward issuing CBDCs as some proceed with experiments.

Kanda said the rapid innovation of digital technology provides various benefits but also fresh challenges such as cyber-security, the spread of misinformation, social and political divides, and the risk of destabilising financial markets.

The collapse of crypto exchange FTX last year "was a serious wake-up call" for policymakers to create regulation across borders, he said.

"For crypto assets, there are a bit of diverging views among countries. But consensus is definitely that we need more regulation, particularly after the FTX shock," Kanda said.

Another priority of this year's G7 talks will be to address debt vulnerabilities of some middle-income countries, said Kanda, who is among policymakers gathering in Washington for the spring International Monetary Fund (IMF) meetings this week.

Kanda said it might be "a bit difficult" to see concrete results for countries like Zambia, Ghana and Ethiopia, when asked what the accomplishments for debt talks could be this week.

"For Sri Lanka, hopefully we can have progress," with a plan to launch a creditor's committee on Thursday initiated by Japan, France and G20 chair India, Kanda said.