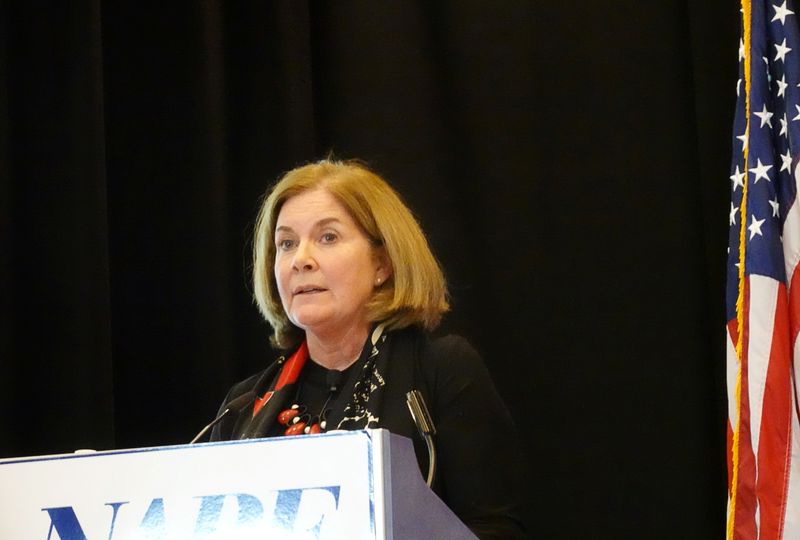

WASHINGTON (Reuters) - The U.S. Federal Reserve's reliance on maintaining an ample balance sheet to help the economy poses risks to financial stability and the central bank's independence, Kansas City Fed Bank President Esther George said on Friday.

"It remains less than clear to me that the longer-run costs of balance sheet policies have been fully taken into account," George said in prepared remarks to the Shadow Open Market Committee economics conference in New York.

"I share ... concerns about the potential side-effects of balance-sheet policies that pose risks to financial stability and threaten the central bank's independence," she said.

George has long been a critic of the Fed's decision to buy Treasury and mortgage-backed securities in response to the 2008 financial crisis and 2007-2009 recession.

Such programs were seen by the Fed as a way to boost growth and employment by lowering borrowing costs and spurring banks to lend to businesses and people.

The Fed currently has more than $4.2 trillion of assets on its balance sheet, including more than $3.8 trillion of bonds.

Most policymakers at the Fed have said that they would be comfortable with implementing a similar program of large-scale asset purchases in the next economic downturn should they be forced to cut interest rates to near zero.

Such a debate has been given added urgency by recent turmoil in financial markets, which have been spooked by the escalating coronavirus outbreak that has spread to the United States.

The Fed cut its key overnight lending rate by half a percentage point on Tuesday to a target range of between 1.00% and 1.25% in an emergency move to mitigate the effects of the flu-like illness on the U.S. economy. Investors are predicting further U.S. rate cuts in the near future.

"These holdings arguably blur the line between monetary policy and credit allocation," George said.