By Jonnelle Marte

NEW YORK (Reuters) - The Federal Reserve is unlikely to need to cut interest rates further in the near term barring a "material change" in the outlook for the U.S. economy, the president of the Boston Fed said on Tuesday.

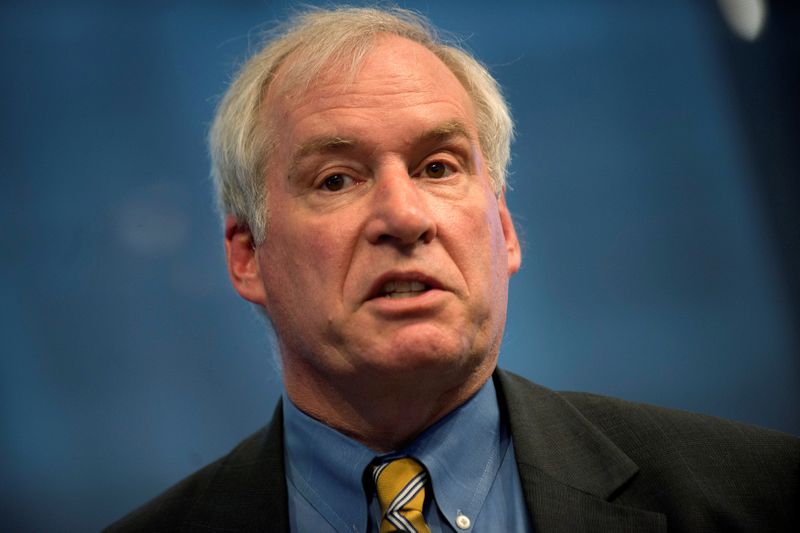

Eric Rosengren, who voted against all three of the U.S. central bank's interest rate reductions this year, also said he sees little chance of an economic downturn in 2020 given the recent positive tone to incoming data, as well as supportive fiscal and monetary policy.

Rosengren's outlook for where interest rates are headed largely mirrored one from Dallas Fed President Robert Kaplan delivered earlier on Tuesday. Both say the appropriate course for the Fed right now is to stay put after lowering borrowing costs three times since July.

That posture is consistent with one signaled by the Fed more widely after it left rates unchanged last week at its final meeting of the year.

Speaking to the Forecasters Club of New York, Rosengren said he expects the U.S. unemployment rate to "fluctuate narrowly around its current value," which is 3.5% and near a half-century low.

The rate of inflation tracked by the Fed is also likely to rise to around its targeted rate of 2%, supported by the strong job market, he said. It most recently was 1.6%, and the Fed has not succeeded in achieving its inflation goal with any consistency in the decade since the financial crisis.

Rosengren, who repeated the recent Fed mantra that the economy is in "a good place," said retailers he has spoken with are optimistic about the holiday sales period.

"Plentiful jobs and growth in income have provided improvements in confidence and bode well for holiday sales and beyond," Rosengren said in his prepared remarks.

Rosengren's prepared remarks made no specific reference to his long-standing concerns about financial stability. His opposition to this year's three rate cuts centered largely on worry that lowering rates could create instability by fanning stretched valuations in some financial markets and enticing low-rated borrowers to take on excessive debt.