By Gwladys Fouche

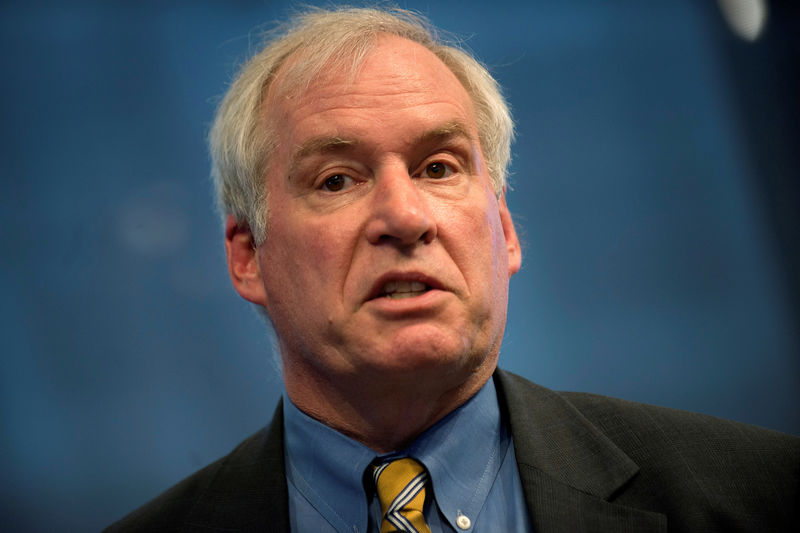

OSLO (Reuters) - Boston Federal Reserve Bank President Eric Rosengren on Monday said the U.S. economy is in good condition and nothing he has seen in recent data would change his view that the Fed's latest interest rate cut was not needed.

"I view the U.S. economy as in pretty good shape right now," Rosengren told Reuters following a speech here. Gross domestic product "looks like it is going to be growing around potential."

"The U.S. economy is in good enough shape that I dissented at the last meeting," he said. "I did not think the last cut was necessary, and I certainly think that there is nothing that has come in since that meeting that would change my view."

Concerned by weak U.S. business investment, persistently soft domestic inflation and a widespread slowdown in global economic growth, the U.S. central bank has cut interest rates three times since July in what policymakers have described as a "mid-cycle adjustment."

Rosengren, who voted against each of the rate cuts, said inflation "is a little bit below our 2% target but not dramatically below."

The Fed's benchmark overnight lending rate now stands in a range of 1.50-1.75%, down from 2.25-2.50% at mid-year. Fed Chair Jerome Powell and others have signaled that their most recent cut in October was likely the last for now.

Rosengren, in Oslo for a financial regulation conference hosted by Norges Bank, Norway's central bank, declined to say whether he would support a decision expected at the Fed's next in December to leave rates where they are.

"I don't make decisions until the meeting," he said.

Earlier, in response to questions from the audience after his speech on banking regulation, Rosengren said the Fed is unlikely to cut interest rates below zero to combat an economic downturn.

The prevalence of negative rates in Europe, however, leaves the Fed less room to maneuver, Rosengren said.

Rosengren's speech focused on banking regulation, not U.S. monetary policy or the economic outlook.

In response to a question from the audience, Rosengren said he would advocate forcing banks to shut down dividend payments and share repurchases if another downturn threatened the health of the banking system.