By Jonnelle Marte

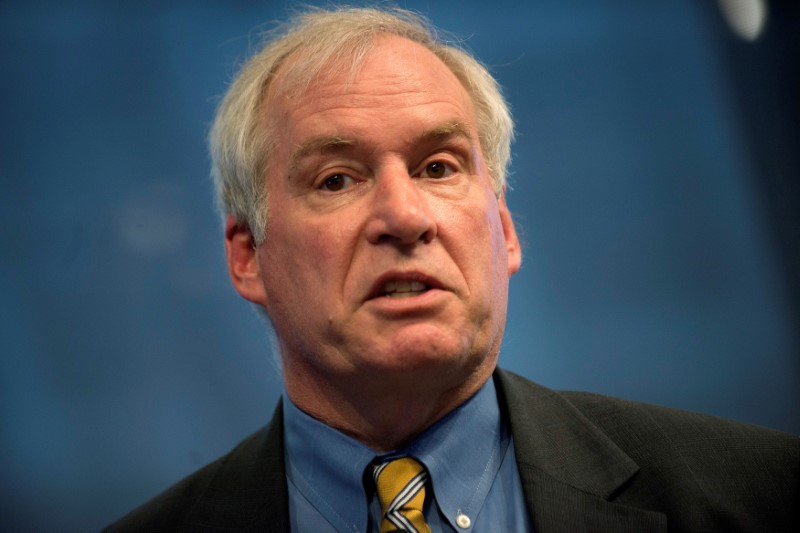

(Reuters) - Boston Federal Reserve Bank President Eric Rosengren said there is little the U.S. central bank can do to address the health threats posed by the coronavirus pandemic, but that officials are doing what they can to minimize the spillover into financial markets.

The Money Market Mutual Fund Liquidity Facility unveiled on Wednesday night is meant to boost confidence in money market funds and to prevent funds from having to sell assets in a "fire sale" to meet redemption requests, which could lower their value, Rosengren said in an interview with Reuters on Thursday.

"We saw that there was some runoff starting last week and continuing into this week and this facility was designed to make sure that some of that runoff didn’t become a more significant problem," Rosengren said.

The facility will make up to one-year loans to financial institutions that pledge as collateral high-quality assets, such as U.S. Treasury bonds, that they have purchased from money market mutual funds.

Policymakers are taking steps to support the economy and keep credit flowing to businesses and consumers in the face of extreme market volatility caused by the coronavirus pandemic.

The central bank slashed rates on Sunday to near zero and announced it will purchase at least $700 billion in Treasury securities and mortgage-backed securities to improve market functioning. The Fed has also revived or adjusted several programs used during the 2007-2009 financial crisis to boost liquidity, including launching a commercial paper funding facility and opening dollar swap lines with more central banks.

The Fed's new money market fund facility, which will be offered through the Boston Fed, is similar to a tool launched during the last recession but it accepts a wider array of assets, including unsecured commercial paper. Because of that greater risk, the Fed is receiving up to $10 billion in credit protection from the Treasury Department, Rosengren said.

The policymaker said he expects the U.S. economy to "suffer a significant shock" because of the pandemic, which has led to a surge in job losses as businesses close and people are asked to avoid large groups to slow the spread of the virus. Initial jobless claims jumped up by 70,000 last week to the highest level in more than two years, the Labor Department said Thursday.

Yet, Rosengren struck a cautiously optimistic tone. "But I'm fully confident that over time, financial markets will be resilient and the U.S. economy will come back," he said.