By Jonnelle Marte

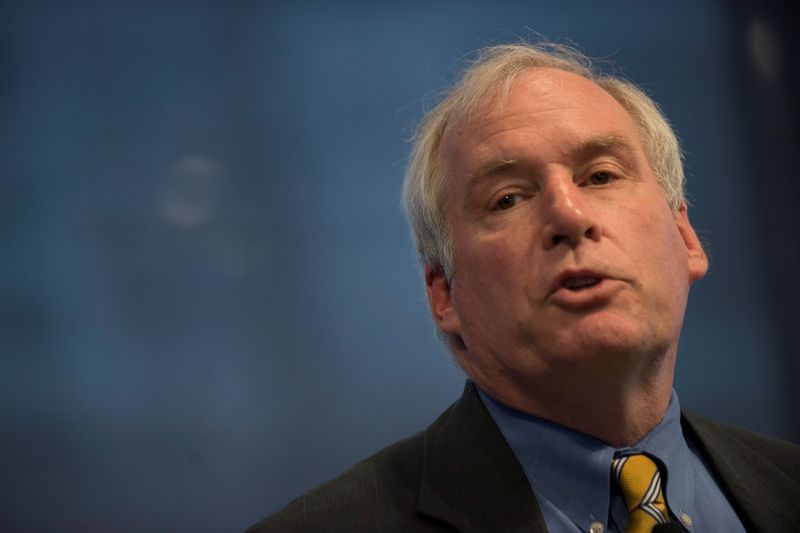

(Reuters) - The U.S. economy could recover more slowly than expected from the economic crisis caused by the novel coronavirus, and demand for the Federal Reserve's Main Street lending program, which aims to support small and mid-sized businesses, could grow over time, Boston Federal Reserve Bank President Eric Rosengren said on Wednesday.

Rosengren said the program got off to a quiet start, but he shared a grim outlook in which companies and lenders that initially stayed away from the facility may realize they need more help than expected.

"There are actually a lot of companies that have been badly disrupted by the pandemic," he said in an interview. "I do expect unfortunately that the economy is going to remain weaker than many had hoped through the summer and fall and this will be an important way to make sure that firms don't close."

More than 400 lenders have either registered or are in the process of signing up for the program, Rosengren said. No Main Street loans had been completed as of last week, but Rosengren said lenders are starting to receive applications from borrowers across industries, including movie theaters, software companies and oil well servicers.

The Boston Fed, which is administering the program, published a partial list of participating lenders on Wednesday on its website https://www.bostonfed.org/supervision-and-regulation/supervision/special-facilities/main-street-lending-program/information-for-borrowers.aspx. The central bank also announced this week that it is ready to start purchasing loans from lenders, which will need to hold on to a 5% stake.

The Fed has made several adjustments to the program after receiving thousands of letters with feedback, including lowering the minimum loan amount, expanding the loan term to five years and introducing a proposal to make loans available for nonprofit groups. Rosengren said the term sheet on the nonprofit loan program should be available within the next week.