By Jonnelle Marte and Lindsay (NYSE:LNN) Dunsmuir

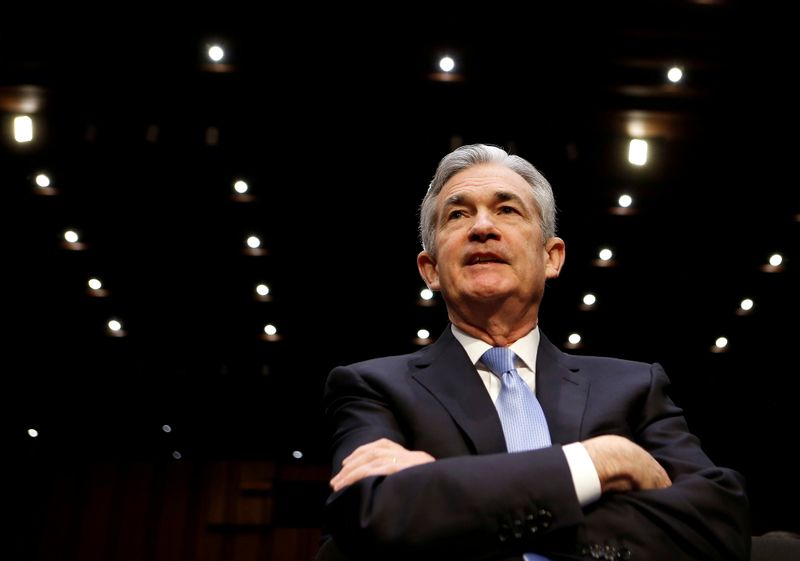

NEW YORK (Reuters) - The U.S. central bank needs to be ready to respond to the possibility that inflation may not recede in the second half of next year as most forecasters currently expect, Federal Reserve Chair Jerome Powell said on Wednesday.

In his second day of testimony in Congress, Powell reiterated that he and fellow policymakers will consider at their upcoming meeting a faster wind-down to the Fed's bond-buying program, a move widely seen as opening the door to earlier interest rates hikes.

With very strong consumer demand colliding with persistent supply chain problems, the Fed may be nearing the time when it must choose between aiming for full employment and keeping inflation in check.

On Tuesday, Powell said he thinks it's likely that inflation will come down "meaningfully" in the second half of next year as supply chains get fixed, but "the risks of higher inflation have moved up."

"We have to use our policy to address the range of plausible outcomes, not just the most likely one," he told the U.S. House of Representatives Financial Services Committee.

As if to underscore those concerns, a survey published Wednesday by the Federal Reserve showed firms across the country are increasingly grappling with higher prices and scrambling to fill jobs amid labor shortages, though they are able in many cases to pass on higher costs to customers, with little resistance. "Nearly all Districts reported robust wage growth," according to the Fed's Beige Book, an anecdotal survey of businesses in the Fed's 12 districts.

Soon after Powell's appearance in Congress alongside Treasury Secretary Janet Yellen, public health officials announced the first known U.S. case of a patient with the Omicron COVID-19 variant, suspected of being more infectious than prior strains of the coronavirus.

Though lawmakers asked Powell no questions about how the new variant might change the economic outlook or the Fed's policy response, New York Fed President John Williams told the New York Times in an interview published Wednesday that it could both slow economic activity and exacerbate inflationary pressures.

That daunting combination could add to the challenges Fed policymakers face as they calibrate their response to the good news from a strengthening economy, the bad news of a possible new COVID-19 surge, and inflation that is persisting longer and staying higher than expected.

Last month, the Fed began reducing its purchases of Treasuries and mortgage-backed securities from $120 billion per month at a pace that would put it on track to end purchases by mid-2022. The program was introduced in early 2020 to help nurse the economy through the pandemic.

Powell repeated Tuesday that policymakers would discuss at their Dec. 14-15 meeting whether to end that program a few months earlier in light of the strength of the economy.

TENSION

Powell said the U.S. recovery is stronger than those of other major economies, thanks in part to more robust fiscal support. U.S. consumer spending surged in October and first-time applications for unemployment benefits are at a 52-year low, leading economists to raise their GDP growth estimates for the fourth quarter.

Still, consumer confidence dropped to a nine-month low in November amid worries about the rising cost of living and pandemic fatigue. The Omicron variant is also creating more uncertainty for households and businesses.

Powell said Fed officials are monitoring the evolving economic landscape and acknowledged they might face "tension" as they pursue the U.S. central bank's dual mandate of achieving maximum employment and price stability.

"We have to balance those two goals when they are in tension, as they are right now," Powell said. "But I assure you we will use our tools to make sure that this high inflation we are experiencing does not become entrenched."

Powell noted that wages have been rising, particularly for low-wage workers, and said the Fed is tracking the increases.

"We have seen wages moving up significantly," Powell said. "We don’t see them moving up at a troubling rate that would tend to spark higher inflation, but that’s something we’re watching very carefully."