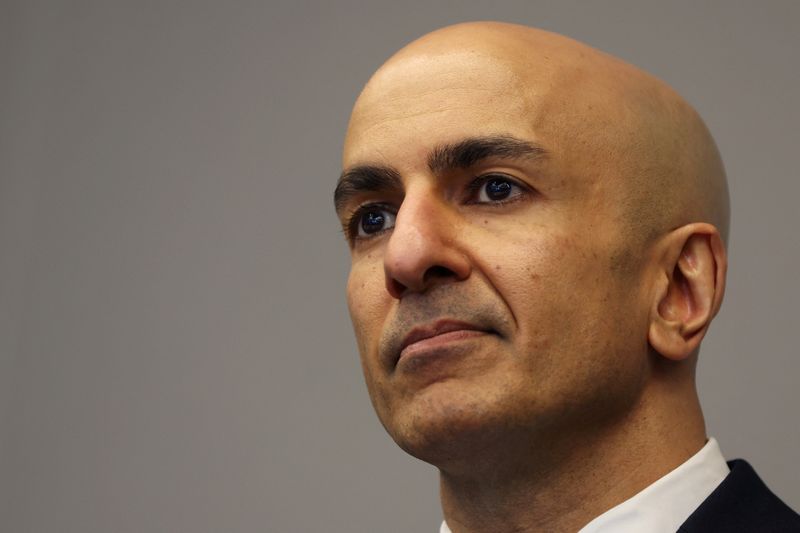

(Reuters) - U.S. financial regulators should take steps to ensure banks can withstand further interest-rate hikes should the Federal Reserve need to deliver them to fight entrenched inflation, Minneapolis Fed President Neel Kashkari said on Wednesday.

The failure of several large regional banks in the spring highlighted what can happen when banks are poorly positioned to handle securities losses, on paper or otherwise, triggered by rising interest rates as the Fed tightened monetary policy to battle decades-high inflation.

If inflation proves persistent and the Fed needs to raise interest rates further, Kashkari said, stresses on some banks could reemerge, forcing the central bank to make a difficult choice between vanquishing inflation and supporting financial stability.

"Central banks' fight to bring inflation back to target and preserve anchored expectations must succeed," Kashkari said in an essay, adding that policy rates may need to rise further. "One way supervisors could ensure banks are prepared is to run new high-inflation stress tests to identify at-risk banks and size individual capital shortfalls."

Markets currently expect inflation to fall fairly quickly, he said, and if so, the value of bank-held securities would likely climb, automatically strengthening bank balance sheets and easing stress.

But core inflation is running stubbornly high, at more than twice the Fed's 2% target, he noted. If it is entrenched, "policy rates might need to go higher," he said, which could hurt the value of bank holdings, lead to stagflation or a recession, and potentially trigger deposit flight from banks seen as less able to meet their obligations.

Fed policymakers last month opted to interrupt what had been a series of 10 straight interest-rate hikes, leaving the policy rate steady at 5.00%-5.25% to give themselves time to assess how higher interest rates were affecting bank credit, economic growth and prices.

They are widely expected to raise rates by another quarter of a percentage point at their upcoming policy meeting on July 25-26, and possibly once again later this year, to deal a more decisive blow to inflation.

Kashkari has been a proponent of raising rates, though he did not say in his essay whether he would support an increase at the Fed's July meeting.