By Michael S. Derby

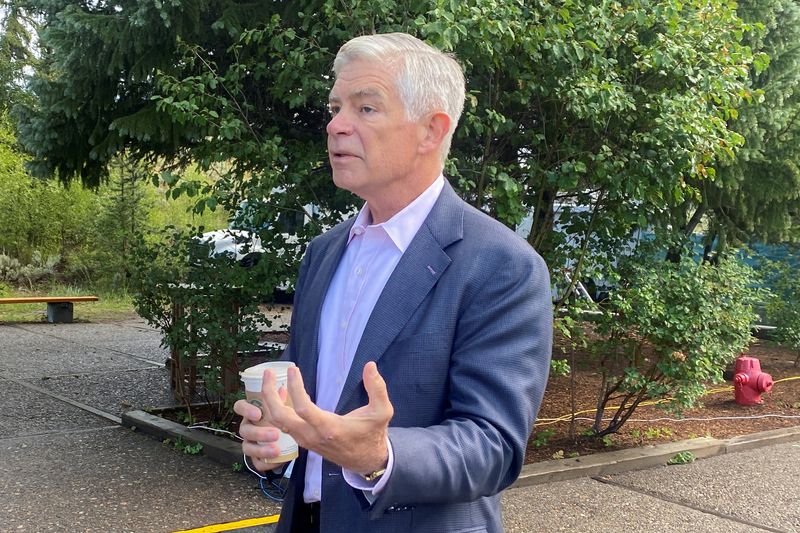

NEW YORK (Reuters) - Federal Reserve Bank of Philadelphia President Patrick Harker said Thursday the U.S. central bank will have to do more on the policy front to get still high inflation pressures back down to the 2% target.

“Some additional tightening may be needed to ensure policy is restrictive enough to support both pillars of our dual mandate,” Harker said in the text of a speech to be delivered before a gathering at Wharton School of the University of Pennsylvania. “Once we reach that point, which should happen this year, I expect that we will hold rates in place and let monetary policy do its work,” he said.

Harker is currently a voting member of the rate setting Federal Open Market Committee, which next meets on May 2-3 in a gathering that’s widely expected to result in a quarter percentage hike in what is now a 4.75% and 5% federal funds rate range. Fed forecasts from late March projected one more increase after that before holding steady for the year, in a view affirmed by a number of recent policy makers’ comments.

In his speech, Harker said the economy remains strong and inflation is coming down, albeit slowly. Compared to the 5% annualized rise in the personal consumption expenditures price index, he sees inflation falling to 3% to 3.5% this year and to 2% in 2025.

Harker said the current 3.5% unemployment rate should move up to around 4.4% this year, in a period where growth will be tepid.

The bank president also said that last month’s financial sector woes will also weigh on the economy.

“It will take some time to evaluate how recent events may impact overall economic activity and inflation,” the official said, adding “I expect to see tighter credit conditions for households and businesses that may slow economic activity and hiring, but the full extent is still unclear.”