By Michael S. Derby

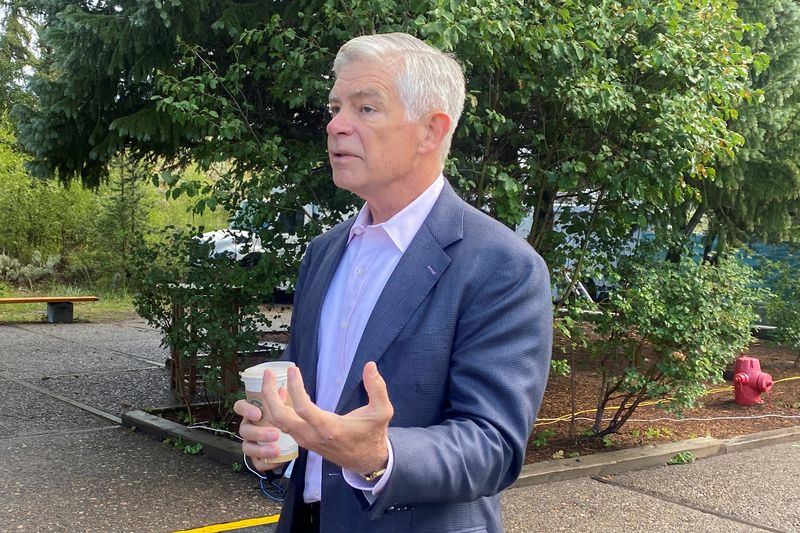

NEW YORK (Reuters) -Federal Reserve Bank of Philadelphia leader Patrick Harker said Thursday that the U.S. central bank is approaching a point where it may be able to moderate the pace of its rate rise campaign aimed at lowering too-high levels of inflation.

“In the upcoming months, in light of the cumulative tightening we have achieved, I expect we will slow the pace of our rate hikes as we approach a sufficiently restrictive stance,” Harker said in a speech in Philadelphia. But he added that moving from what had been 75 basis point increases to something like a half percentage point rise would still be a significant action.

Harker added, “at some point next year, I expect we will hold at a restrictive rate for a while to let monetary policy do its work” as more expensive borrowing costs impact the economy. The central banker said what happens after that will be driven by the data and added “if we have to, we can always tighten further, based on the data.”

The policymaker gave some guidance about where he believes the central bank can stop and take stock of its work.

"I am in the camp of wanting to get to what would clearly be a restrictive stance, somewhere north of four-ish, you know, four and a half percent, and then I would be OK with taking a brief pause, seeing how things are moving."

Harker spoke as a number of other central bank officials have signaled the possibility of slower rate rises over coming months. Newly installed Dallas Fed leader Lorrie Logan, speaking separately Thursday, also expressed openness toward a shift in central bank policy.

The rate-setting Federal Open Market Committee has increased the cost of short-term borrowing very rapidly this year, moving from a near zero short-term rate target to between 3.75% and 4% following last week’s 75 basis point rate rise.

The Fed is trying to lower very high levels of inflation but there are increasing worries that its policy actions could send the economy into a recession or break something in financial markets, given how aggressive the shift in monetary policy has been.

Harker, who doesn’t hold a vote on the FOMC this year but will in 2023, laid out what it will take for him to call for a shift in monetary policy. “What we really need to see is a sustained decline in a number of inflation indicators before we let up on tightening monetary policy,” he said, adding “we need to make sure inflation expectations don’t become unanchored.”

In his remarks, Harker said there are signs the economy is slowing but he added “the job market continues to run extremely hot” and inflation “remains far, far too high.”

Harker said in his speech that he believes the U.S. gross domestic product will be flat for this year, rise by 1.5% next year and 2% in 2024. Unemployment should rise from its current 3.7% level to 4.5% next year before falling to 4% in 2024. He said there’s evidence the Fed can lower inflation “without doing unnecessary damage to the labor market.”

As for inflation, he said inflation as measured by the core personal consumption expenditures price index, which stood at 5.1% in September, should ease to 4.8% this year, 3.5% next year and 2.5% in 2024. The Fed’s target is 2%.

Harker also said in his speech that he doesn't see rising risk from credit markets right now, although he noted that commercial real estate markets, which have been stressed by the pandemic, are worth watching.