By Michael S. Derby

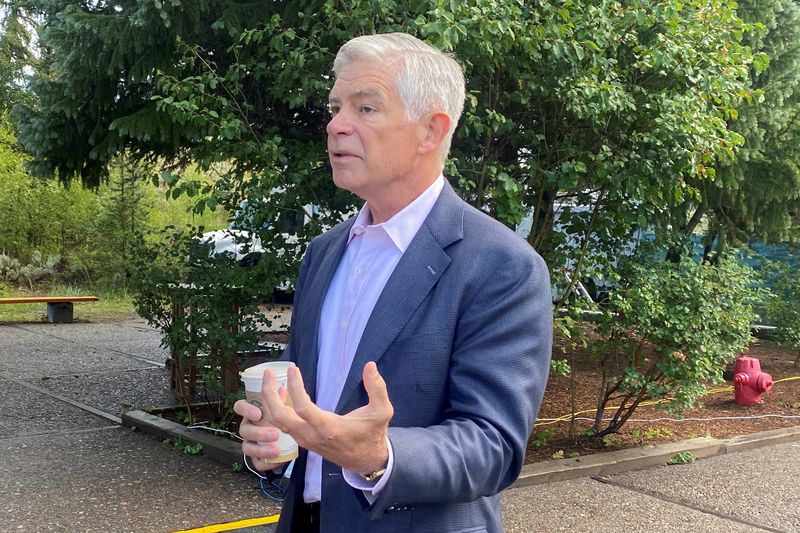

(Reuters) - The Federal Reserve made the right choice last week to hold interest rates steady amid an outlook that likely heralds more inflation declines, Patrick Harker, president of the Philadelphia Fed, said on Tuesday.

The policy decision last Wednesday “is one I support,” Harker said in the text of a speech prepared for an event in Glassboro, New Jersey.

“The data point to continued disinflation, to labor markets coming into better balance, and to resilient consumer spending — three elements necessary for us to stick to the soft landing we remain optimistic to achieve,” said Harker, who is not a voter on the policy-setting Federal Open Market Committee this year. He said “real progress” is being made in getting inflation back to the Fed’s 2% target.

Last week, officials kept their overnight target rate range steady at between 5.25% and 5.5% and signaled that with inflation moving down, the next step is likely to lower short-term borrowing costs.

But Fed Chair Jerome Powell, speaking after the Fed meeting, pushed back on the idea of a rate cut at the March policy meeting. Other Fed officials have said it could take some time to determine whether it’s time to lower rates after what had been an aggressive campaign raising them to combat high levels of inflation.

Harker did not say in his prepared remarks what he expects on the rate-cut front. But he said that Fed action “has put us on the path to a soft landing,” and given how the data has come in, “the runway at our destination is in sight.”

Harker had been one of the first Fed officials to argue that the central bank was done with rate hikes.