By Michael S. Derby

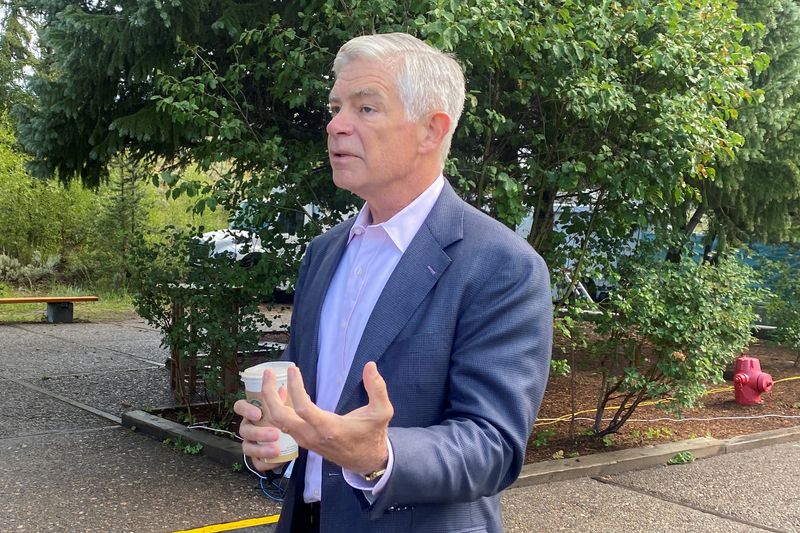

NEW YORK (Reuters) -Federal Reserve Bank of Philadelphia President Patrick Harker said on Tuesday a housing shortage is a key driver of the nation's historic surge in inflation.

"Since the Great Recession, the United States has not built enough housing to keep price growth relatively modest," Harker said in an essay published on the bank's website. This shortage is "a major driver of the far-too-high inflation plaguing our country," he added.

"Inflation is far too high across most goods and services in our economy," Harker said, noting that the Fed "is working to stabilize inflation and put the economy on a firmer footing for the long haul."

Harker, a nonvoting member of the rate-setting Federal Open Market Committee, did not comment on the monetary policy outlook in his essay.

The central bank has been pressing forward with aggressive rate hikes aimed at taming the highest inflation in four decades. Last week, the FOMC hiked its overnight target rate range by 0.75 percentage point, to between 3% and 3.25%, as it signaled more increases ahead.

Fed officials and many private sector economists tie the inflation surge to pandemic-related disruptions and periods of aggressive government stimulus. Housing has been a key factor in rising prices.

Harker's essay noted that housing-driven inflation is "particularly alarming" in part because along with food price increases, housing factors affect almost all Americans.

Moreover, "high housing inflation is a macroeconomic problem; money spent on housing is money not spent on education, durable goods, or meals out," he added.

"We must do everything we can to get shelter inflation under control."