By Michael S. Derby

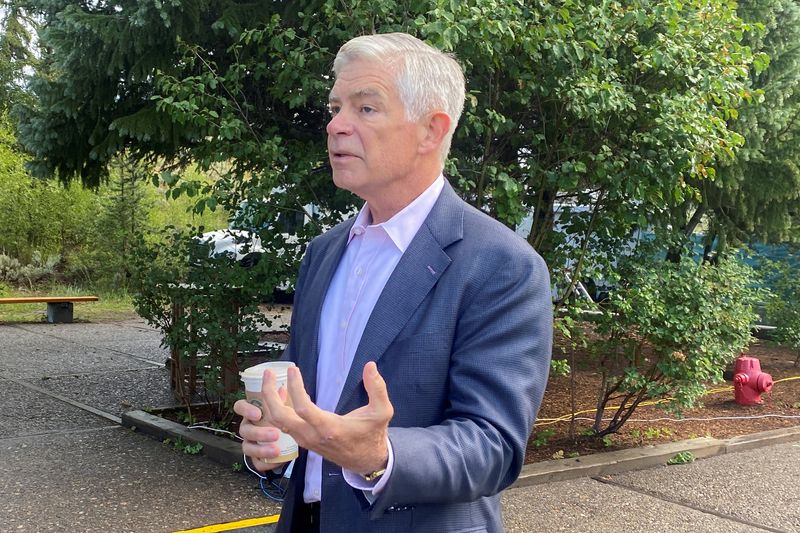

NEW YORK (Reuters) -Philadelphia Federal Reserve President Patrick Harker said on Friday he believes the U.S. central bank is likely done with its cycle of interest rate hikes amid an ongoing waning in price pressures.

"Absent a stark turn in what I see in the data and hear from contacts ... I believe that we are at the point where we can hold rates where they are," Harker said in a virtual speech to the Delaware State Chamber of Commerce.

"It will take some time for the full impact of the higher rates to be felt," he said, adding that "holding rates steady will let monetary policy do its work," and as monetary policy is now restrictive, "we will steadily press down on inflation and bring markets into a better balance."

"By doing nothing, we are still doing something," Harker said, adding "we are doing quite a lot."

Harker weighed in as markets actively debate whether the Fed will raise rates again. The central bank, which has raised rates by 5.25 percentage points in the past 19 months, held its benchmark overnight interest rate steady in the 5.25%-5.50% range last month amid softening inflation pressures. Fed policymakers also penciled in one more hike this year and projected the policy rate will stay higher for longer than they expected at the start of the summer.

Harker noted that he supports the Fed's longer-range expectations for monetary policy, while flagging the uncertainty of how long rates will need to remain elevated.

Recent economic data, while showing strength, has driven home to many in markets the prospect the Fed is done with its tightening cycle, and a number of Fed officials, pointing to higher bond yields, which make credit more expensive and act as a greater headwind to growth, have signaled they could also be done with hikes.

Harker noted after his formal remarks that the spillover impact of higher rates on sectors of the economy like housing provided another argument against further increases in borrowing costs. He noted that high mortgage rates related to Fed policy are locking people into their current homes and are thwarting those who'd like to buy their first homes. Things like this are "why I'm very cautious about raising rates more than where we are" right now, Harker said.

Harker was upbeat about the economy while pointing to a series of risks, noting that "disinflation is under way. Economic activity has been resilient. Labor markets are coming into better balance."

He said he sees a "steady disinflation" that will take price pressures below 3% this year and to the Fed's 2% target after that. Harker said he expects growth to continue this year but at a slower pace next year, adding that "even as I foresee the rate of GDP growth moderating, I do not see it contracting. I do not anticipate a recession."

Harker noted that U.S. labor strikes and the restart of student loan payments could weigh on the economy. He said the unemployment rate will likely rise a touch to about 4%, though he added that he does not see mass layoffs coming.