By Howard Schneider

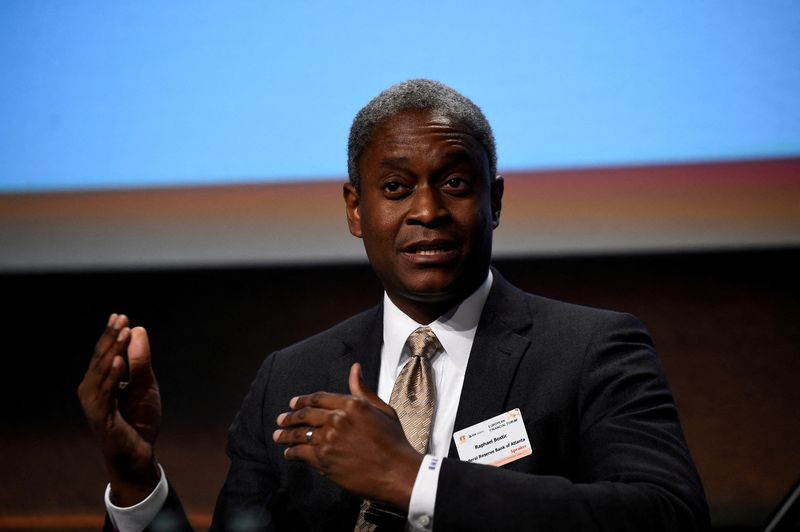

WASHINGTON (Reuters) - Atlanta Federal Reserve President Raphael Bostic said Saturday he is ready to "move away" from three-quarter-point rate hikes at the Fed's December meeting and feels the Fed's target policy rate need rise no more than another percentage point to tackle inflation.

"If the economy proceeds as I expect, I believe that 75 to 100 basis points of additional tightening will be warranted," Bostic said in remarks prepared for delivery at the Southern Economic Association. "I believe this level of the policy rate will be sufficient to rein in inflation over a reasonable time horizon."

That would set the Fed policy rate at a range between 4.75 and 5%, slightly below the peak rate expected by investors. It is currently set in a range between 3.75% and 4%.

The Fed at its December meeting is expected to raise rates by half a percentage point after using three-quarter point increments at its last four meetings, a view endorsed by Bostic as well as a range of other Fed officials recently.

Bostic said that given the inflation surprises of the past year, it is possible the "landing rate" might be higher than he currently anticipates, and that he was going to be "flexible in my thinking about both the appropriate policy stance and the pacing."

But at some point, he said, the Fed would need to pause and "let the economic dynamics play out," given that it may take what he estimate as anywhere from 12 to 24 months for the impact of Fed rate increases to be "fully realized."

"Being more cautious as policy moves deeper into restrictive territory seems prudent," Bostic said, even if it turns out to be the case that rates have to be raised again later.

One thing the Fed should guard against, Bostic said, is any temptation to cut rates before inflation is "well on track" to fall to the Fed's 2% target, even if the economy were to "weaken appreciably."

"We want the public and markets to clearly understand our aims, and the fact that we are going to be unwavering in the pursuit to bring underlying inflation back toward our 2% objective," Bostic said.

Recent inflation data have come in lower than expected. But key price increase measures have still been running at 2 to 3 times the Fed's target level.