By Ann Saphir

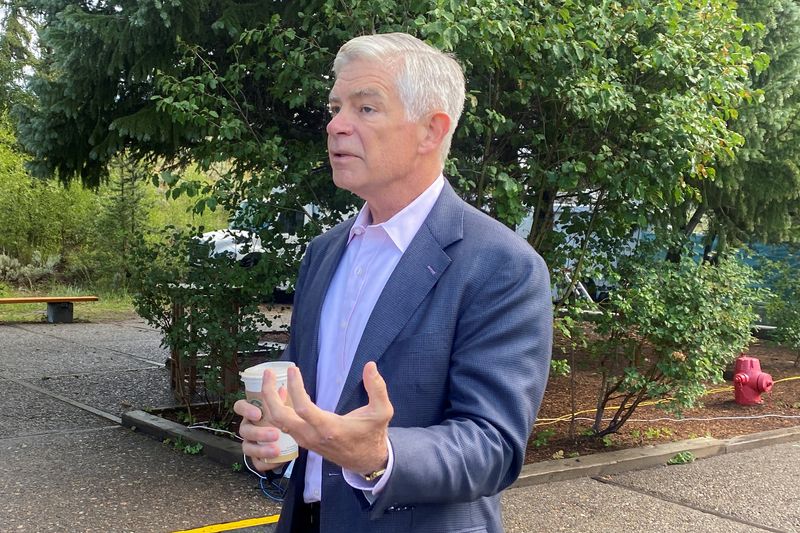

(Reuters) -Philadelphia Federal Reserve Bank President Patrick Harker on Tuesday said he feels the U.S. central bank may soon be done raising interest rates, a year into its most rapid monetary policy tightening since the 1980s.

"Since the full impact of monetary policy actions can take as much as 18 months to work its way through the economy, we will continue to look closely at available data to determine what, if any, additional actions we may need to take," Harker said in a speech at the Wharton Initiative on Financial Policy and Regulation.

"But make no mistake: We are fully committed to bringing inflation back down to our 2% target."

Harker joined his fellow U.S. central bankers last month in voting for a quarter of a percentage point increase in the benchmark overnight interest rate, taking it to a range of 4.75% to 5.00%.

The Fed signaled at the time that most policymakers expected one more increase before calling it quits on a rate-hike campaign that began in March 2022.

In a question-and-answer session following his speech, Harker said he was among that majority. "I'm in the camp of getting up above 5 and then sitting there for a while," he said.

Recent inflation readings "show that disinflation is proceeding slowly - which is disappointing, to say the least," Harker said. The Fed targets 2% inflation which, by its preferred measure, is still running at about 5%.

Still, he said, "we're already seeing promising signs" that the Fed's rate hikes are working, particularly to bring down house prices.

Chicago Fed President Austan Goolsbee earlier on Tuesday said he was focused on parsing the potential impact of tighter credit conditions on the economy in the run-up to the Fed's May 2-3 meeting.