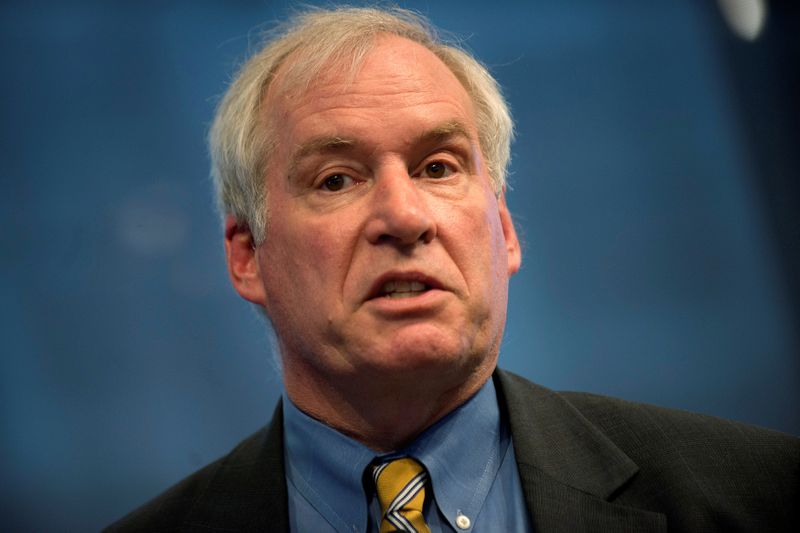

WASHINGTON (Reuters) - The Federal Reserve should be allowed to purchase a broader range of securities and assets if the coronavirus outbreak forces the U.S. central bank to launch a new round of big asset purchases to stimulate the economy, Boston Fed President Eric Rosengren said on Friday.

The central bank has begun to grapple with what measures it would use if the outbreak of the flu-like illness worsens in the United States and causes a severe economic downturn.

"We should allow the central bank to purchase a broader range of securities or assets," Rosengren said in prepared remarks to the Shadow Open Market Committee economics conference in New York, noting it would require a change to the Fed's mandate as set by Congress.

The Fed slashed its key overnight lending rate by half a percentage point on Tuesday to a target range of between 1.00% and 1.25% in an emergency move to mitigate the effects of the escalating global coronavirus outbreak on the U.S. economy. Investors are predicting further U.S. rate cuts in the near future.

Rosengren said such an approach would be necessary because if the Fed was forced to slash rates to effectively zero, the circumstances could have changed, which would limit the effectiveness of purchasing only Treasury and mortgage-backed securities, as the central bank did in the 2007-2009 recession. Those large-scale asset purchases are known as quantitative easing (QE), with the aim of stimulating the economy.

That change is the drop in the 10-year U.S. Treasury yield. It fell to a record low of 0.66% earlier on Friday, on pace for its largest daily fall since October 2011 during the depths of the euro zone sovereign debt crisis, amid concerns the coronavirus outbreak could cause a global recession.

"There would be little room for the Federal Reserve to lower rates through large purchases of long-term Treasury securities - like it did to make conditions more accommodative in and after the Great Recession - if a recession occurred in this rate environment," Rosengren said.

If the Fed did change its policy, it should be accompanied by agreement from the U.S. Treasury to indemnify the central bank against losses, Rosengren added.

He did not specify what types of other securities or assets the Fed would buy.

Rosengren also said he remained skeptical about introducing negative interest rates to the United States. Other central banks including in Europe in Japan, have pushed rates below zero.

"In my view, negative interest rates poorly position an economy to recover from a downturn," Rosengren said.