By Howard Schneider

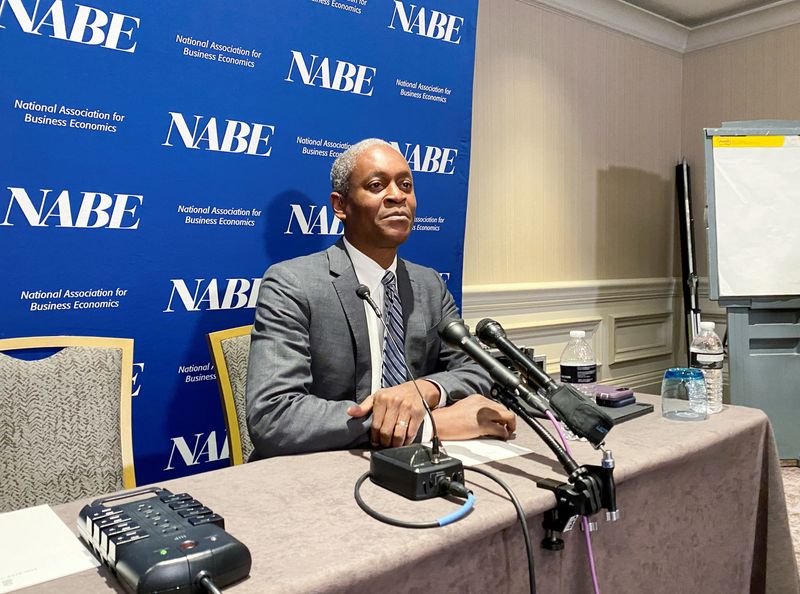

WASHINGTON (Reuters) -The U.S. central bank can begin reducing interest rates "sometime in the third quarter" of 2024 if inflation falls as expected, Atlanta Federal Reserve President Raphael Bostic said on Friday, pushing back against expectations of an imminent move but outlining a deliberative process that will gather steam in coming weeks.

Bostic said he expects inflation, as measured by the personal consumption expenditures (PCE) price index, to end 2024 at around 2.4%, enough progress towards the Fed's 2% target to warrant two quarter-percentage-point rate cuts over the second half of next year.

"I'm not really feeling that this is an imminent thing," Bostic said in an interview with Reuters, with policymakers still needing "several months" to accumulate enough data and confidence that inflation will continue to fall before moving away from the policy rate's current 5.25%-5.50% range.

But Bostic also said he has asked his staff to begin discussing principles and thresholds to help frame the debate.

"We've got to figure out definitionally what the 'neighborhood' looks like" where the inflation outlook is such that rate cuts are warranted, Bostic said. "Over the next several weeks ... I think we are going to start talking about that."

CAUTIOUS APPROACH

Bostic's remarks put detail around a policy shift that the Fed began at its policy meeting this week, when officials agreed that, absent another inflation shock, the current policy rate is high enough to curb the price pressures they have been battling for two years.

Investors have run with the comparatively dovish tone that Fed Chair Jerome Powell struck at a press conference after the end of the meeting on Wednesday, pushing down market-based interest rates and increasing bets the central bank will begin to reduce interest rates at its meeting in March.

The comments from Bostic, a voting member of the central bank's policy-setting Federal Open Market Committee (FOMC) next year, are potentially telling in that regard. He was ready to stop raising rates earlier than his colleagues, saying as of this past June that he felt monetary policy was already restrictive enough - before the FOMC raised the policy rate by another quarter of a percentage point at its July meeting.

Bostic also said that inflation has fallen faster than he anticipated since then, despite continued growth in an economy he feels will skirt any appreciable rise in the unemployment rate, delivering the "soft landing" hoped for by the Fed.

But just as he was cautious about raising rates too far, Bostic said he will be cautious about cutting them too soon. He said he wants to be sure inflation is fully contained before lowering borrowing costs, and avoid being "surprised." Indeed, his outlook for two 25-basis-point rate cuts is less than the 75 basis points or more in cuts seen by many of his colleagues.

"We've been getting close to the neighborhood," Bostic said, adding that he regarded the three- and six-month measures of inflation as "useful markers" for the discussion. Those measures currently stand at around 2.5% for the PCE price index excluding food and energy items, considered by many officials as an important guide to underlying inflation.

But "I am going to try not to presuppose anything at this point," he said. "We've been surprised throughout the pandemic on a number of fronts, some to the good and some to the bad. And so I just don't want to get anchored too much."

BALANCED RISKS

But Bostic said he wanted to be prepared to move more quickly, if needed, in an environment where he felt risks to the economy had become "fairly balanced" between inflation proving stronger than expected - the main worry of policymakers since 2021 - and a deeper-than-anticipated blow to jobs or growth.

"The risk that inflation is going to spike has really, I think, declined significantly. It is not zero, but it is lower," Bostic said, with the easing of price pressures allowing room to "think about the risks to both sides of the mandate."

By statute the Fed is responsible for maintaining stable prices and maximum employment.

Bostic said that in conversations with businesses "no one is talking to me as if large job losses are imminent," and he expects the unemployment rate to end 2024 at 4% - low by historic standards in the U.S. and only a modest rise from the current 3.7%.

But "that is something I'm going to keep an ear out for in the next three to six months to see if that changes," he said. "We want to make sure we are not triggering something that leads to losses that wouldn't be necessary for us to get to the 2% target."

Even so, an interview aired later in the day on Marketplace radio, Bostic doubled down on his cautious approach to easing back policy.

"This is the time when we’ve got to be resolute, and make sure that we don’t jump to conclusions and declare victory," he said, noting that with inflation still above target, "Look, there’s still a ways to go."