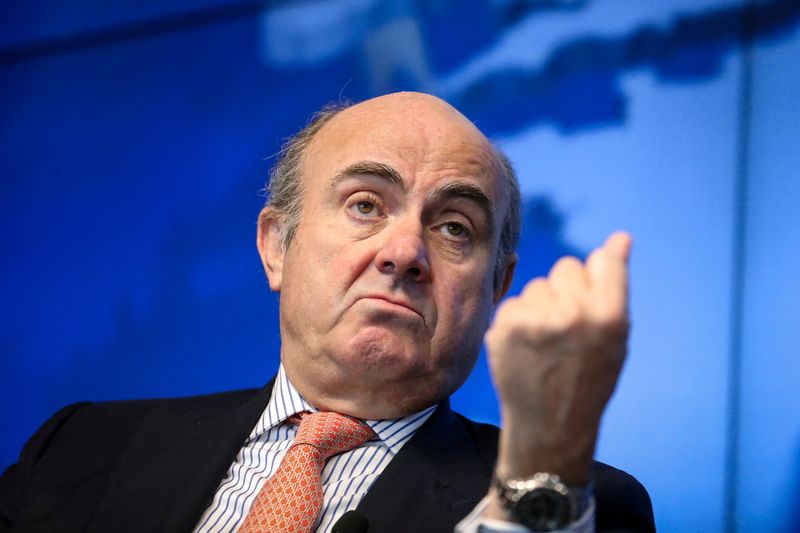

MADRID (Reuters) -Euro zone inflation is becoming increasingly broad while growth is weakening as the bloc struggles with the fallout from Russia's war in Ukraine, European Central Bank Vice President Luis de Guindos said on Monday.

"We are seeing that in the third and fourth quarters there is a significant slowdown and we may find ourselves with growth rates close to zero," de Guindos told a conference.

Inflation is expected to have accelerated to 9.6% this month, a record high for the 19-country currency bloc, while underlying price growth, which filters out volatile food and fuels prices, is also seen accelerating.

To combat higher borrowing costs, the ECB raised rates earlier this month by an unprecedented 75 basis points just weeks after a 50 basis point move and promised several more steps over the coming months as euro zone inflation was at its highest rate in nearly a half a century and at risk of becoming entrenched.

Investors are currently split between a 50-and a 75-basis point rate hike in October, with subsequent increases seen at every meeting through next spring.

De Guindos did not give any clue what magnitude any next increase in interest rates would look like but added that future moves would be "data-dependent", saying that inflation pressures had increased recently.