By Jorgelina do Rosario

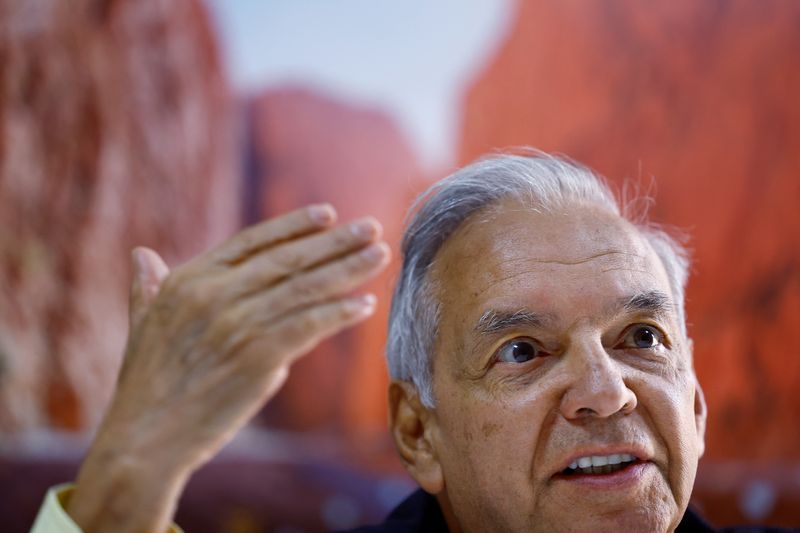

MARRAKECH (Reuters) -Colombian Finance Minister Ricardo Bonilla said on Saturday his ministry was working with the central bank towards cutting its benchmark interest rate from 13.25% to 13% at October's policy meeting, with another reduction seen before year-end.

"The expectation is for another cut in December," Bonilla told Reuters on the sidelines of the World Bank and International Monetary Fund meetings in Marrakech.

"The message of reducing the key rate is for all the banks, because today the rate is an obstacle for economic recovery," he added.

The central bank held the key rate steady at 13.25% in September for the third time in a row, citing stubborn inflation. Bonilla said inflation was set to reach 9.2% at the end of 2023.

Bonilla, who represents the government on the seven-member board, has pushed before for rate cuts.

Two members voted for a borrowing cost decrease at the board's September meeting, though the bank does not reveal how each member voted. Five members voted to keep borrowing costs stable at 13.25%.

Colombian President Gustavo Petro voiced disappointment over the September decision and said he hoped cuts would come soon.

Colombia's consumer prices rose by 0.54% in September, taking cumulative 12-month price growth to 10.99%. That was down from highs in 2022, but still more than double the central bank's long-term target of 3%.

The central bank's technical team expects Colombia's economy to grow 0.9% this year, compared with an expansion of 7.3% in 2022.

Bonilla said the conflict between Israel and Hamas "will surely impact in oil prices," and could force the government to make an additional hike to domestic fuel prices.

He added that Congress should be able to pass labor, pension and health reform bills during the first half of 2024 as part of the government's efforts to reduce poverty and inequality.