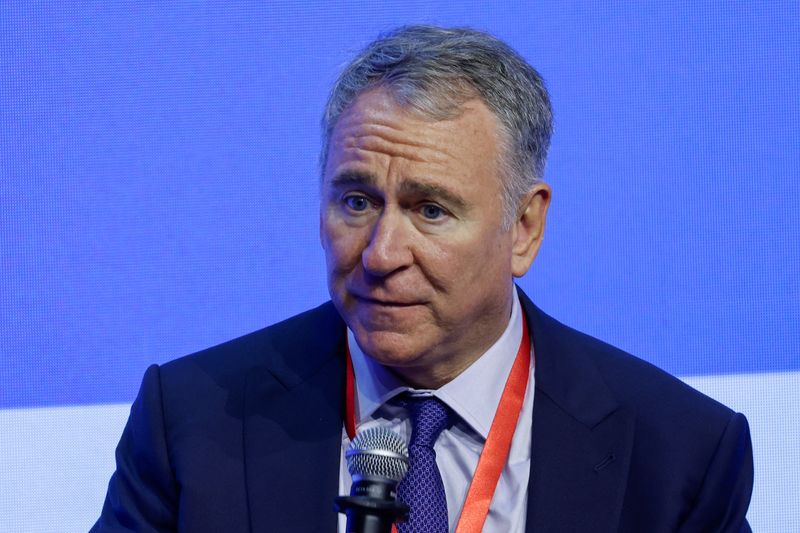

(Reuters) - Cooling inflation in the United States gives the Federal Reserve room to potentially start cutting interest rates this summer, Citadel founder and billionaire investor Ken Griffin said on Tuesday.

The timing of potential rate cuts has been the subject of speculation and debate in the markets for months. Most traders expect the central bank to kick off the cuts in May.

Data released by the Commerce Department last week showed U.S. prices rose marginally in December, keeping the annual increase in inflation below 3% for a third consecutive month.

Griffin, however, cautioned against the growing fiscal deficit in the U.S., a risk that several business leaders have ranked as one of their chief concerns about the economy.

"We are still engaged in a reckless level of federal spending. That is creating a very different backdrop for the economy than any point in prior history," he said at the Managed Funds Association Network conference in Miami.

The federal government not cutting back on its spending could lead to a loss of confidence in the creditworthiness of the U.S. in 7 to 10 years, which is the "biggest systemic risk" the economy is staring at, he added.

In the wide-ranging interview, Griffin also attacked the perceived anti-business stance of President Joe Biden's administration.

"This administration seems to be very focused on regulations that reduce the access to public market capital.... or make it more expensive to run a business," he said.

Griffin's hedge fund giant Citadel is among the biggest in the U.S. Last month, Reuters reported the fund was planning to give back $7 billion of profits to its investors after a year of double-digit returns. It had also done so the previous year, when it posted a record profit.