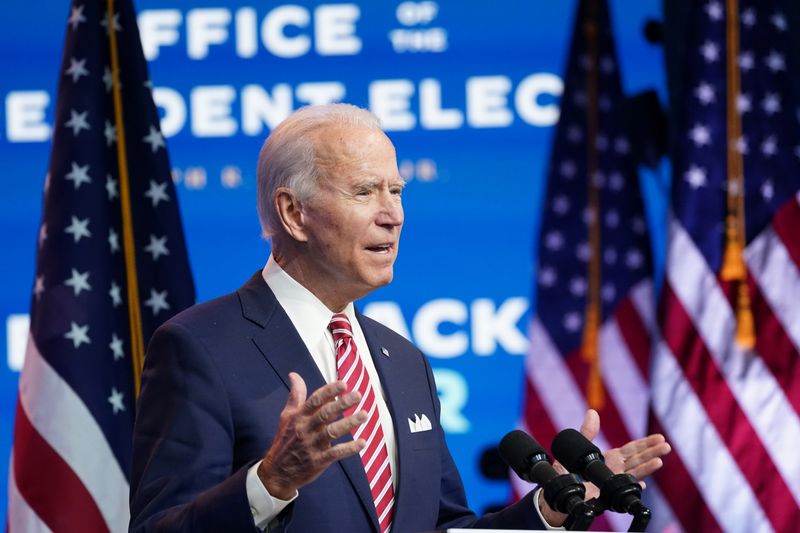

BEIJING (Reuters) - A top Chinese securities regulator said on Tuesday that he hopes Sino-U.S. relations will be much improved under a Biden administration.

Under U.S. President Donald Trump's administration, ties between China and the United States are at their worst in decades over disputes ranging from technology and trade to Hong Kong and the coronavirus.

Beijing has said it expects the incoming Biden administration to meet China halfway, manage differences and push for the advancement of Sino-U.S. ties on the right track.

"I sincerely hope at the end of the four years of the Biden administration, U.S.-China relations will be in a much, much better state than (they are) today," said China Securities Regulatory Commission Vice Chairman Fang Xinghai.

Meanwhile, Beijing should be able to resolve accounting issues with Chinese firms under a Biden administration, said Fang, who was speaking during a session of the Bloomberg New Economy Forum.

In August, U.S. Securities and Exchange Commission and Treasury officials urged Trump to delist Chinese companies that trade on U.S. exchanges and fail to meet its auditing requirements by January 2022.

Fang, asked whether Ant Group's planned $37 billion initial public offering would eventually go ahead, said that depends on how the government restructures the regulatory framework on financial technology, and how the company reacts to the changing regulatory environment.

Ant, with its unique business model and the absence of rivals in China or elsewhere, has mainly thrived as a technology platform away from the banking sector's regulations, despite its array of financial products, analysts say.

But Beijing has become uncomfortable with banks increasingly using micro-lenders or third-party technology platforms such as Ant for underwriting loans amid fears of rising defaults and a deterioration in asset quality in a pandemic-hit economy.