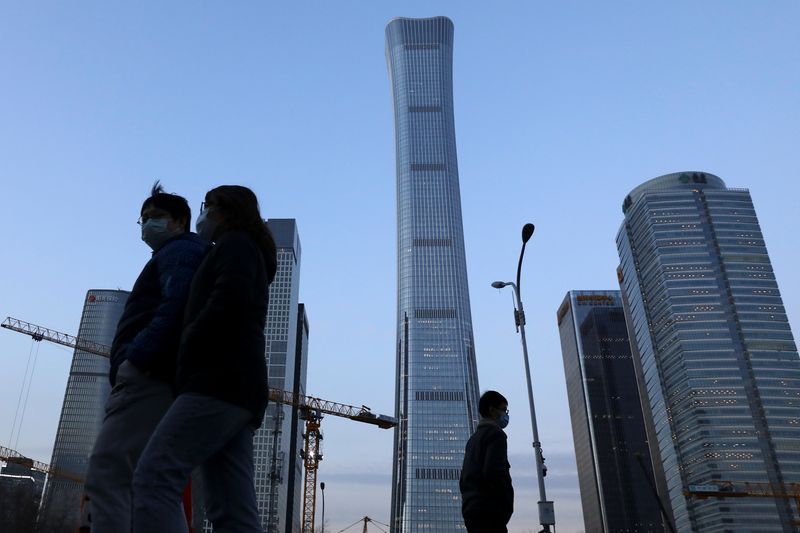

BEIJING (Reuters) -The growth of China's government fiscal revenue slowed in March compared with the first two months of the year, finance ministry data showed on Wednesday, further weighing on a flagging recovery, already weakened by COVID flare-ups.

Last month's government fiscal revenue rose 3.42% year-on-year to 1.5834 trillion yuan ($91.03 billion), slowing from a 10.5% growth in January-February, according to Reuters calculations based on the official data.

The country's fiscal spending growth accelerated to 10.4% year-on-year to 2.536 trillion yuan in March, after a 7.0% growth in January-February.

For the entire quarter, fiscal revenue rose 8.6% while spending was up 8.3%.

For March, land sales revenues fell 22.84% from a year earlier to 403.6 billion yuan, after a 29.5% plunge in the first two months, as cash-strapped developers grew cautious about land purchases.

The finances of local governments have come under pressure as cuts in taxes and fees by the central government to support the economy and a property market downturn weighed on fiscal revenues and land sales.

Governments in less-developed regions and those that traditionally rely on land auctions have been particularly hard-hit.

Many local governments have illegally issued debt to raise funds as fiscal revenues plummeted due to COVID-19, Chinese financial news outlet Yicai reported on Wednesday.

China has also warned against the rise of so-called "hidden debt", or off-balance sheet borrowing, incurred by local governments.

Local government hidden debts reached 45 trillion yuan at the end of 2020, Nomura has estimated.

Economists say fiscal deficits of China's local and regional governments will widen this year due to increasing economic headwinds and even more fiscal support ordered by Beijing.

"The continued contraction in land markets will likely weigh on local government land sales revenues and infrastructure investment," Nomura said in a note on April 18.

This week, the Chinese capital Beijing eased some land buying curbs on developers, which have been squeezed by a government crackdown on new borrowing in the indebted sector.

More than 80 cities have also eased curbs on home purchases this year to support the ailing property market.

($1 = 6.4090 Chinese yuan renminbi)