(Bloomberg) -- Terms of Trade is a daily newsletter that untangles a world embroiled in trade wars. Sign up here.

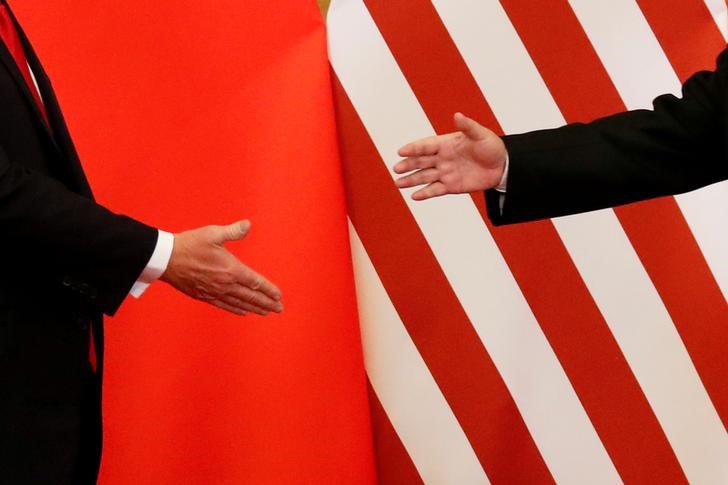

Chinese officials are casting doubts about reaching a comprehensive long-term trade deal with the U.S. even as the two sides get close to signing a “phase one” agreement.

In private conversations with visitors to Beijing and other interlocutors in recent weeks, Chinese officials have warned they won’t budge on the thorniest issues, according to people familiar with the matter. They remain concerned about President Donald Trump’s impulsive nature and the risk he may back out of even the limited deal both sides say they want to sign in the coming weeks.

Chinese policy makers are gathered in Beijing for a key political meeting that’s set to conclude on Thursday. In meetings ahead of that plenum some officials have relayed low expectations that future negotiations could result in anything meaningful -- unless the U.S. is willing to roll back more of the tariffs. In some cases, they’ve urged American visitors to carry that very message back to Washington, the people said.

Chilean President Sebastian Pinera threw up another hurdle when he announced Wednesday that the country had canceled the Asia-Pacific Economic Cooperation summit Nov. 16-17 -- where Trump and China’s Xi Jinping hoped to meet -- because of social unrest in the country.

U.S. stocks futures and government bond yields declined.

A White House spokesman said Wednesday, after the news of the cancellation, that the administration remains committed to “finalizing Phase One of the historic trade deal with China within the same time frame.”

That first step, according to the Trump administration, is meant to lead to a more comprehensive agreement involving more substantial economic reforms than those contained in the proposed initial phase. But Chinese officials are skeptical, saying that would require the U.S. to withdraw tariffs in place on some $360 billion in imports from China -- something many don’t see Trump being ready to do.

The people familiar with China’s position said the tariffs don’t all have to be removed immediately, but they must be part of the next stage. China also wants Trump to cancel a new wave of import taxes due to take effect Dec. 15 on American consumer favorites such as smartphones and toys as part of the phase one deal, the people said.

Beijing is open and willing to continue talks after an initial phase, but both sides recognize that it will be very difficult to reach an agreement on the deep structural reforms the U.S. is pushing for, said one Chinese official familiar with the talks.

China has stated for months that a final deal must include the removal of all punitive tariffs, and has balked at reforms in areas such as state-run enterprises that could jeopardize the Communist Party’s grip on power. It’s politically unfeasible for Xi to accept any deal that would keep the punitive tariffs: Nationalists in the party have pressured him through state-run media editorials to avoid signing an “unequal treaty” reminiscent of those China signed with colonial powers.

Tariff Pressure

So far, U.S. Trade Representative Robert Lighthizer and his team, which declined to comment, have been adamant that the duties on $250 billion in Chinese goods -- imposed early in the trade war -- be maintained over the long term as a way to enforce any commitments China makes.

The questions over the future of negotiations reflect a change in U.S. strategy. After ramping up tariffs and pressure on China over the summer and saying he would settle only for an all-encompassing agreement, Trump in early October shifted to the step-by-step approach.

The first phase, which negotiators are still trying to nail down, is expected to include a resumption of Chinese purchases of U.S. farm goods and other products such as aircraft.

It’s also expected to include Chinese commitments to protect American intellectual property and an agreement by both sides not to manipulate their currencies. In return, Trump agreed not to go ahead with an Oct. 15 tariff increase and aides have raised the possibility of canceling the Dec. 15 levies.

But missing from the deal now taking shape are many of the deeper economic reforms such as a changes to the regime of government subsidies Chinese companies benefit from that the Trump administration – and American businesses – have been seeking, raising questions over whether the economic cost of Trump’s trade assault will have been worth it.

Trump has sought to preempt criticism that he’s getting little from China by arguing that the tougher issues will be dealt with in future phases. “Phase two will start negotiations almost immediately after we’ve concluded phase one,” he told reporters this month.

Modelling Global GDP Impact of Trade War

Yet the move to a phased approach reflects China’s resistance to many U.S. demands and a concession by the White House to abandon its stance that nothing is agreed until all the thorny issues are resolved.

“Even if they do get a phase one, a phase two is going to be substantially more difficult because all the really difficult issues are being deferred,” said Eswar Prasad, who once led the International Monetary Fund’s China team and is now at Cornell University.

During recent conversations with senior Chinese policy makers, Prasad said the common theme they expressed was skepticism. “They are quite pessimistic,” he said. “They fear that any deal that they negotiate with Trump could blow up in their face.”

The differences were evident even as Trump announced the “substantial phase one deal” with China’s lead negotiator, Vice Premier Liu He, and promised a broader thaw in relations as part of what he dubbed a “love-fest.”

Behind closed doors though, the mood was not quite as fulsome. According to people close to the talks, the sides were still debating how to apportion issues between phases and what to announce just minutes before reporters were let in for the announcement.

‘Positive Direction’

Trump declared before the press that there could be as many as three phases to a deal while Liu declined to discuss details.

“We very much agree that to get the China-U.S. economic relationship right, it’s something that is good for China, for the United States, and for the whole world and we are making a lot of progress toward a positive direction,” Liu told reporters.

China’s Ministry of Commerce did not immediately respond to a fax seeking comment on the trade talks. But a former official says there could still be a long road ahead.

“If the U.S. demands are too much, such as insisting on the so-called structural changes that will alter China’s economic model, then the complete deal can’t be finished during Trump’s first term,” said Zhou Xiaoming, a former Ministry of Commerce official. “Other than that, China wants to have a deal as quickly as possible” though a complete deal would include the removal of all punitive tariffs, he said.

That’s far from what the Trump administration is prepared to offer. “It’s not obvious that there is a real meeting of minds,” Prasad said.