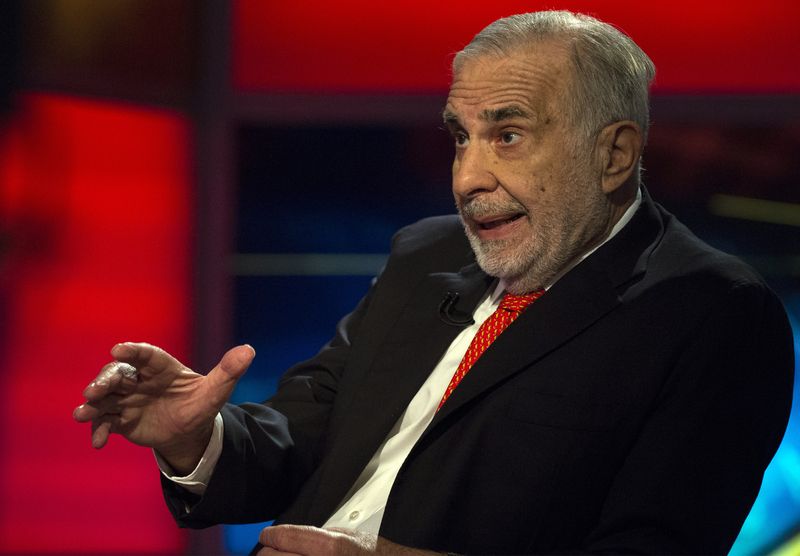

(Reuters) -Carl Icahn disclosed on Monday he restructured $3.7 billion in personal loans to remove a link between his obligation to post collateral and his holding company's share price, buoying the stock which had been battered following an attack by short-seller Nathan Anderson.

Shares of Icahn Enterprises LP (IEP) had dropped as much as 64% after Anderson's Hindenburg Research published a report in May accusing the company of overvaluing its holdings and relying on a "Ponzi-like" structure to pay dividends.

This posed a threat to Icahn, who owns 85% of IEP and had used about 60% of his stake in the company to borrow from a group of banks. Icahn was obligated to post more collateral as the value of IEP's stock dropped. The share price milestones that triggered these obligations have not been disclosed.

IEP shares had been popular with wealthy investors, in part for the generous dividend. Icahn, who elects to take his dividend in IEP stock rather than cash, called Hindenburg's report "self-serving" and vowed to "fight back."

The 87-year-old investor said in filings on Monday that he had consolidated these loans into a new a three-year loan agreement with Bank of America (NYSE:BAC), Bank of Montreal, Morgan Stanley (NYSE:MS), Deutsche Bank AG (NYSE:DB), National Association and M&T Bank (NYSE:MTB). A requirement for Icahn to post more collateral is now tied to IEP's indicative net asset value, rather than IEP's share price, according to the filings.

IEP shares were up 21% at $35.05 on Monday afternoon, hitting their highest level since May 9. That is still well below the May 1 closing price of $50.42. Hindenburg published its report on May 2.

In the amended loan agreement, Icahn agreed to provide additional collateral of $2 billion from his personal funds and 320 million IEP shares.

Icahn will repay principal of $500 million on or before Sept. 1, eight quarterly principal payments of $87.5 million beginning a year after that, and a final principal payment of $2.5 billion at the end of the term, according to the filings.

It was not immediately clear what impact the new agreement with the banks would have on Icahn's wealth, which has been pegged by Forbes at $10.5 billion. It was also not clear how this might affect the ability of Icahn, one of the world's most prominent activist investors, to stalk companies.

Icahn did not respond to requests for comment.

Days after Hindenburg published its report, IEP said in a regulatory filing that the U.S. Attorney's Office for the Southern District of New York was investigating the company. The federal law enforcement officials are "seeking production of information relating to it and certain of its affiliates’ corporate governance, capitalization, securities offerings, dividends, valuation, marketing materials, due diligence and other materials," IEP said.

The company has provided no update since then.