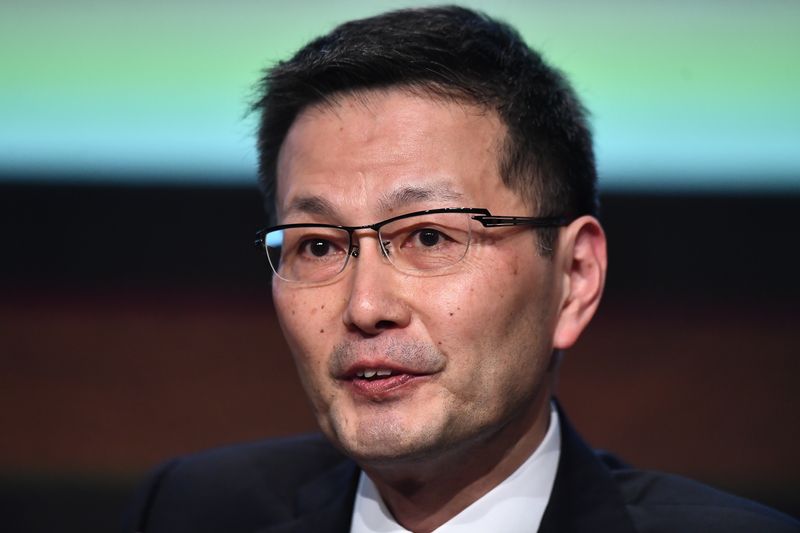

TOKYO (Reuters) - Even as cost-push factors boost inflation, global central banks must be vigilant to the risk of "Japanification", in which their economies face prolonged low inflation and stagnation, said Bank of Japan (BOJ) Deputy Governor Masazumi Wakatabe.

Various structural factors could weigh on the neutral rate, or the rate at which monetary policy is neither stimulating nor restricting growth, across the globe, he said.

That means the main challenge for central banks would be to effectively push down real interest rates to reflate their economies, Wakatabe told an academic conference, according to a text of his speech released on Saturday.

"When looking at history, the mild inflation regime has not ended and the potential danger of prolonged economic stagnation, or 'Japanification', has not been dispelled," he said.

"What Japan's long experience with deflation shows is that it's quite hard to eradicate fears of deflation," said Wakatabe, who is known as a vocal advocate of aggressive monetary easing.

BOJ Governor Haruhiko Kuroda deployed a massive asset-buying programme in 2013 to pull Japan out of nearly two decades of deflation, which was blamed for prolonging its economic stagnation because firms and households hoarded cash instead of spending it.

After heavy money printing failed to fire up inflation to a 2% target, the BOJ shifted in 2016 to a policy targeting interest rates. It continues to maintain ultra-low rates, even as rising raw material costs push inflation above the target.

Wakatabe, whose five-year term as deputy governor ends in March, has consistently stressed the need to keep monetary policy ultra-loose to put a sustained end to deflation.