By Leika Kihara

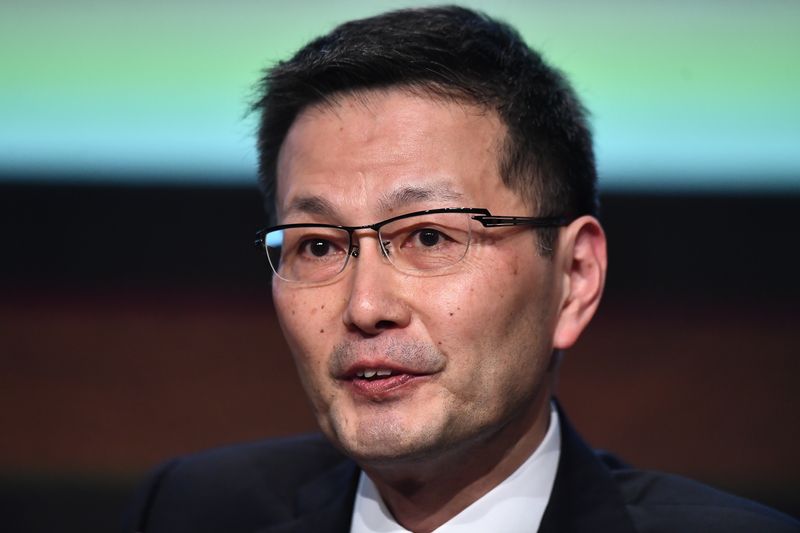

WASHINGTON (Reuters) - Bank of Japan Deputy Governor Masazumi Wakatabe said on Saturday the yen's recent fluctuations were "clearly too rapid and too one-sided," signalling caution over the potential economic damage from the currency's slump to 32-year lows against the dollar.

Wakatabe, speaking in a seminar during the IMF and World Bank annual meetings in Washington, also said Japan's government has made clear there was no discrepancy or inconsistency between its efforts to tame excessive yen declines, and the BOJ's ultra-easy monetary policy aimed at achieving its 2% inflation target.

"Prime Minister (Fumio) Kishida supports the easy monetary policy to get out of a low inflationary environment," Wakatabe said when asked whether the BOJ's ultra-low interest rate policy was driving down the yen, and contradicting the government's efforts to curb sharp yen falls through currency intervention.

He pointed to the Japanese leader's recent remarks to the Financial Times that the BOJ needed to maintain its ultra-loose policy until wages went higher.

When asked about the yen's recent sharp declines, the BOJ deputy governor said: "When it comes to foreign exchange fluctuations right now, it's clearly too rapid and too one-sided."

Under Japanese law, the Ministry of Finance, not the BOJ, has jurisdiction over exchange-rate policy.

Japan intervened in the currency market last month to arrest sharp yen drops, which were driven largely by the policy divergence between aggressive U.S. interest rate hikes and the BOJ's resolve to keep monetary policy ultra-loose.

Wakatabe said the BOJ must maintain ultra-loose monetary policy because wage growth remains weak and inflation expectations, while rising, have yet to be firmly anchored around its 2% inflation target.

"We don't want to overshoot the target and undershoot the target. We'd like to have a stabilized 2% inflation rate down the road. That's when we are going to think about changing policy," Wakatabe said.

"I personally think ... we have to see some core measures (of inflation) move around 2% and the distribution of price changes must be consistent with achieving our 2% target" to consider changing ultra-loose policy, he said.

The BOJ remains an outlier among the world's central banks, many of which are tightening monetary policy to combat soaring inflation, as it focuses on underpinning a fragile economic recovery.

Japan's core consumer inflation accelerated to 2.8% in August, exceeding the BOJ's 2% target for a fifth straight month as price pressures from raw materials and yen weakness broadened.

BOJ Governor Haruhiko Kuroda said in a separate seminar on Saturday that inflation will likely fall below 2% in the next fiscal year, and stressed the need to keep ultra-easy policy.