By Leika Kihara

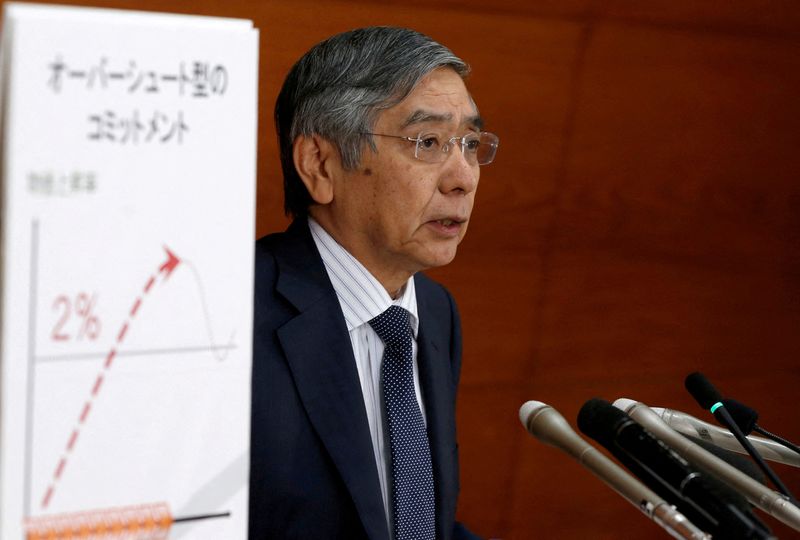

TOKYO (Reuters) -The Bank of Japan has no plan now to change an implicit 0.25% cap set around its yield target, though a tweak in the future cannot be ruled out, governor Haruhiko Kuroda said on Wednesday.

Under yield curve control, the BOJ guides the 10-year Japanese government bond (JGB) yield around 0% as part of efforts to keep borrowing costs low and stimulate the economy.

To breathe life back to a market made dormant by its huge presence, the central bank clarified last year that it will allow the 10-year yield to move 25 basis points up and down each around the target.

"We have no plan now to change the band. But that's not to say the band cannot change forever," Kuroda told parliament.

Kuroda also said the yield curve needs to steepen "to a certain extent," suggesting the BOJ will not intervene to forcefully push down longer-dated yields such as those for 20- and 30-year notes.

"Even if 20- and 30-year JGB yields fall, they won't have much effect in stimulating capital expenditure and consumption. Rather, they risk hurting pension funds' profits," Kuroda said.

The remarks underscores the tricky balance the BOJ faces in keeping borrowing costs low, while seeking to mitigate the strain prolonged ultra-low rates is inflicting on bank profits.

The BOJ on Monday offered to buy an unlimited amount of 10-year JGBs at 0.25% to prevent rising global long-term rates from pushing up JGB yields too much.

"JGB yields were rising rather sharply reflecting higher overseas long-term rates. It was an unusual market situation," Kuroda said in explaining why the BOJ stepped in.

"If something similar happens again, we will of course resort to such a tool. But our basic stance is to buy sufficient amount of JGBs so that the 10-year yield moves 25 points up and down each around our 0% target," he said.

The 10-year JGB yield stood at 0.215% on Wednesday, off the implicit 0.25% cap, due in part to the BOJ's action on Monday.

But longer-dated bond yields continued to rise. The 20-year yield hit 0.7% on Wednesday, the highest since 2017, while the 30-year note saw yields climbed to 0.930%.