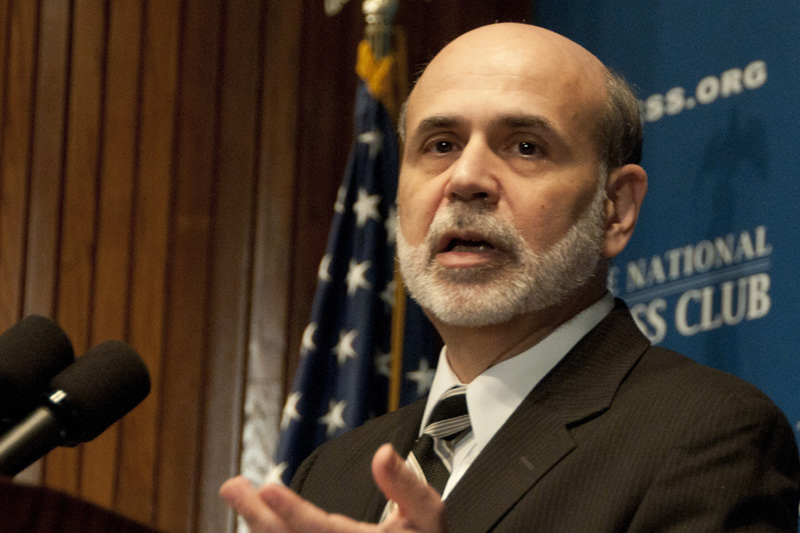

Investing.com - The U.S. economy is on the mend though recovery is incomplete, and any decision to scale back stimulus tools such as monthly bond purchases should not be construed as a step towards policy tightening, outgoing Federal Reserve Chairman Ben Bernanke said Friday.

The Fed is currently purchasing USD75 billion in bonds a month to spur recovery, a monetary policy tool known as quantitative easing that tends to weaken the dollar by suppressing borrowing costs, often sending investors towards asset classes such as stocks.

In December, the Fed trimmed USD10 billion from its bond-buying program, which stood at USD85 billion since September of 2012.

Should the economy continue to improve, the labor market especially, the Fed may scale back the stimulus program even more, but any decision to tighten policy by raising benchmark interest rates remains far off on the horizon.

The unemployment rate stood at 7.0% in November.

"Recovery clearly remains incomplete. At 7 percent, the unemployment rate still is elevated. The number of long-term unemployed remains unusually high, and other measures of labor underutilization, such as the number of people who are working part time for economic reasons, have improved less than the unemployment rate," Bernanke said in prepared remarks of a speech he gave Friday.

"Labor force participation has continued to decline, and, although some of this decline reflects longer-term trends that were in place prior to the crisis, some of it likely reflects potential workers' discouragement about job prospects."

The U.S. benchmark interest rate, the fed funds rate, stands at 0.0%-0.25% and the Fed has said that figure will remain even if the unemployment rate dips below 6.5%, often a threshold at which monetary authorities have said they'll consider tightening.

Bernanke stressed that a 6.5% unemployment rate is a threshold, and not a trigger, meaning that rate hikes might not ensue once the unemployment rate hits that mark and even if quantitative easing programs have wrapped up.

"Crossing one of the thresholds would not automatically give rise to an increase in the federal funds rate target; instead, it would signal only that it would be appropriate for the Committee to begin considering, based on a wider range of indicators, whether and when an increase in the target might be warranted," Bernanke said.

Furthermore, Bernanke stressed, the December decision to begin tapering bond purchases didn't herald the arrival of an end to very loose monetary policy.

"It is important to recognize that the potential signaling aspect of asset purchases depends on the broader economic and policy context. In particular, the FOMC's decision to modestly reduce the pace of asset purchases at its December meeting did not indicate any diminution of its commitment to maintain a highly accommodative monetary policy for as long as needed," Bernanke said.

"Rather, it reflected the progress we have made toward our goal of substantial improvement in the labor market outlook that we set out when we began the current purchase program in September 2012."

The Fed is currently purchasing USD75 billion in bonds a month to spur recovery, a monetary policy tool known as quantitative easing that tends to weaken the dollar by suppressing borrowing costs, often sending investors towards asset classes such as stocks.

In December, the Fed trimmed USD10 billion from its bond-buying program, which stood at USD85 billion since September of 2012.

Should the economy continue to improve, the labor market especially, the Fed may scale back the stimulus program even more, but any decision to tighten policy by raising benchmark interest rates remains far off on the horizon.

The unemployment rate stood at 7.0% in November.

"Recovery clearly remains incomplete. At 7 percent, the unemployment rate still is elevated. The number of long-term unemployed remains unusually high, and other measures of labor underutilization, such as the number of people who are working part time for economic reasons, have improved less than the unemployment rate," Bernanke said in prepared remarks of a speech he gave Friday.

"Labor force participation has continued to decline, and, although some of this decline reflects longer-term trends that were in place prior to the crisis, some of it likely reflects potential workers' discouragement about job prospects."

The U.S. benchmark interest rate, the fed funds rate, stands at 0.0%-0.25% and the Fed has said that figure will remain even if the unemployment rate dips below 6.5%, often a threshold at which monetary authorities have said they'll consider tightening.

Bernanke stressed that a 6.5% unemployment rate is a threshold, and not a trigger, meaning that rate hikes might not ensue once the unemployment rate hits that mark and even if quantitative easing programs have wrapped up.

"Crossing one of the thresholds would not automatically give rise to an increase in the federal funds rate target; instead, it would signal only that it would be appropriate for the Committee to begin considering, based on a wider range of indicators, whether and when an increase in the target might be warranted," Bernanke said.

Furthermore, Bernanke stressed, the December decision to begin tapering bond purchases didn't herald the arrival of an end to very loose monetary policy.

"It is important to recognize that the potential signaling aspect of asset purchases depends on the broader economic and policy context. In particular, the FOMC's decision to modestly reduce the pace of asset purchases at its December meeting did not indicate any diminution of its commitment to maintain a highly accommodative monetary policy for as long as needed," Bernanke said.

"Rather, it reflected the progress we have made toward our goal of substantial improvement in the labor market outlook that we set out when we began the current purchase program in September 2012."