By David Milliken and Andy Bruce

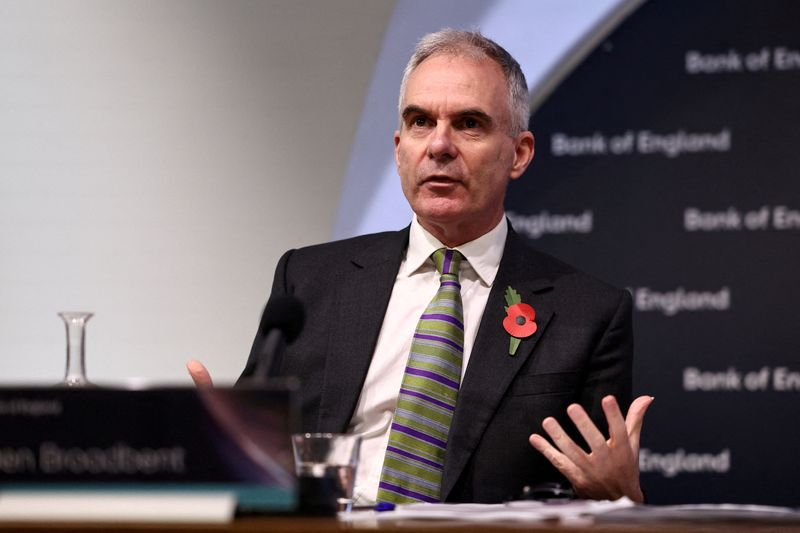

LONDON (Reuters) - The Bank of England could cut interest rates in the next few months, depending on how rapidly the knock-on impact on wage growth and prices from 2022's surge in inflation eases, Deputy Governor Ben Broadbent said on Monday.

Speaking ahead of his final vote in June as a member of the Monetary Policy Committee, Broadbent cited survey evidence from companies that showed a major driver of inflation pressure - strong wage growth - was likely to dissipate only slowly.

However, Broadbent said there were grounds for optimism as prices were now rising more slowly than wages, helping households recover ground lost when inflation surged.

"The more that's regained, the less ground, relative to some notional 'norm', there is to make up," Broadbent said at a central banking conference hosted by the BoE.

This was why he was content to reduce the persistence of inflation pressures embedded in the BoE's latest forecasts, published earlier this month, he said.

"If things continue to evolve with its forecasts - forecasts that suggest policy will have to become less restrictive at some point - then it's possible Bank Rate could be cut some time over the summer," Broadbent said.

Earlier this month, the BoE's MPC voted 7-2 to keep rates on hold at a 16-year high of 5.25% and Broadbent - one of the seven to vote for unchanged policy - said views varied across the MPC on how much evidence was needed to cut rates.

"The experience of the last two or three years has made people wary. Equally, as I said a moment ago, the behaviour of the economy over the last six months ... is reassuring."

Broadbent, deputy governor for monetary policy since 2014, steps down at the end of June and will be replaced by a former senior finance ministry official, Clare Lombardelli.

Broadbent said it was all the more important that Britain retains its current framework of operational independence for the BoE if shocks to the supply side of Britain's economy become more frequent.

Some politicians in Prime Minister Rishi Sunak's Conservative Party - trailing badly in opinion polls ahead of an election due by January 2025 - criticised the BoE as inflation soared into double digits and its bond sale programme generated heavy losses.