SYDNEY (Reuters) - Australian Treasurer Jim Chalmers said on Thursday some recommendations from an independent review of the Australian central bank's monetary policy decision-making and board make-up may require legislative changes to enact.

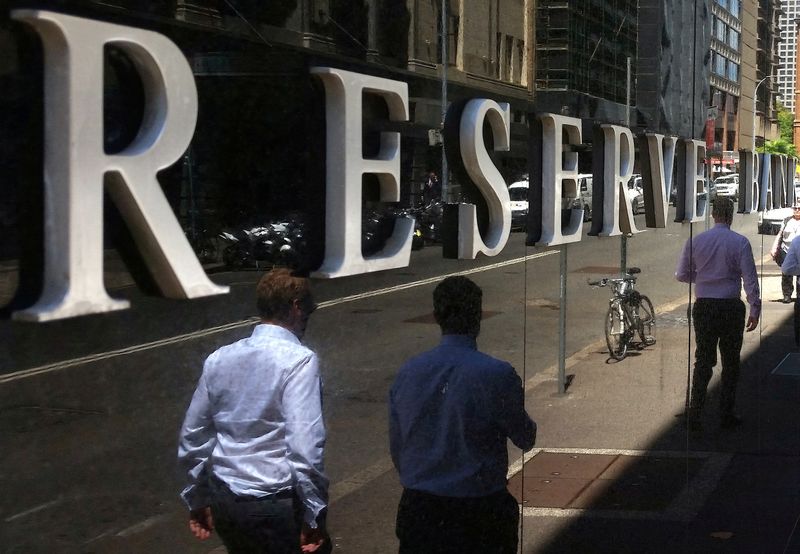

Chalmers said the government would look to reach consensus with the opposition parties to amend any laws "if we go down that path", as he looks set to receive on Friday the findings of the report on the Reserve Bank of Australia (RBA).

"If there are some that require a change to the (RBA Act) that we're keen on progressing, then ideally we would do that in a bipartisan way," Chalmers told ABC Radio.

The independent review, announced by Chalmers in July, will assess how the RBA communicates with the public and weigh the make-up of its board, which consists of two RBA staff, the Treasury secretary and six business people.

The review was called after the RBA undershot its inflation target of 2% to 3% for much of the last decade and issued guidance during the COVID-19 pandemic that rates were not expected to rise until at least 2024. But the RBA has made 10 straight rate hikes since May to tame surging inflation.

Chalmers said he would release the report with the government's initial views next month, ahead of the federal budget in May.

"So I'd like to put it out in April, and people can go through it and see what they think about it," he said.

A decision whether to re-appoint Governor Philip Lowe, whose term ends in September, would be taken "closer to the middle of the year" in consultation with Prime Minister Anthony Albanese and the cabinet, Chalmers said.