By Swati Pandey

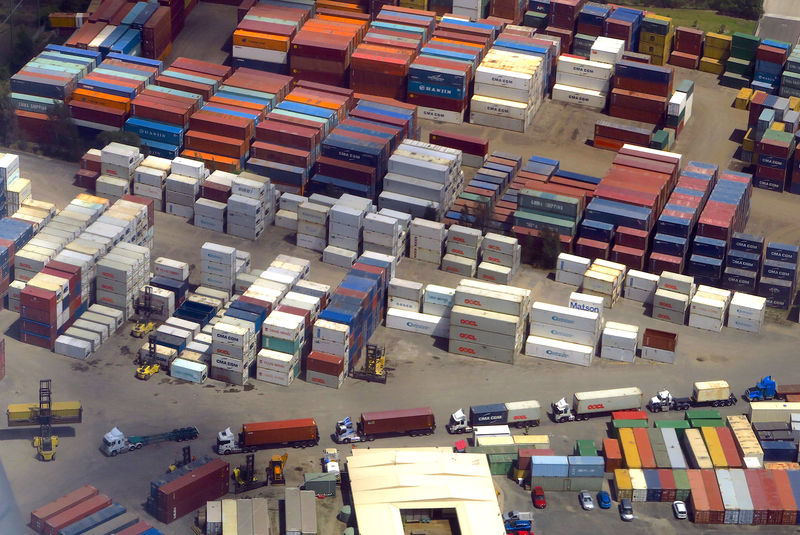

SYDNEY (Reuters) - Australian exporters enjoyed bumper sales last quarter gifting the country its first current account surplus in over four decades, however, wider economic conditions remained sluggish as households crimped spending.

Data out on Tuesday showed Australia swung to a larger-than-expected current account surplus of A$5.9 billion when analysts were looking for a A$1.4 billion windfall, led by higher prices for its key resources - iron ore and coal.

This is the first surplus since June 1975 and the largest on record.

That means net exports added a cool 0.6 percentage points to gross domestic product last quarter.

Data due Wednesday will likely show the A$1.9 trillion economy expanded 0.5% in the quarter-ended June 30 with annual growth seen slowing to a decade low of 1.5%.

In contrast to the blockbuster external economy, Australia's household sector is battling miserly wage growth and subdued home prices with other data showing retail sales fell 0.1% in July. A median of 19 economists had predicted a 0.2% rise.

The weak outcome, which was led by falls in clothing, footwear and personal accessory and department stores, briefly sent the local dollar to the day's low of $0.6696.

Sluggish household consumption has been a major source of worry for the Reserve Bank of Australia (RBA) as the sector accounts for 56% of the economy, and was a major reason policymakers cut the cash rate twice since June to a record low of 1%.

The RBA is likely to stand pat at its monthly board meeting on Tuesday - a decision is due at 0430 GMT - though financial markets are fully pricing in a third easing by November.

"There is certainly plenty to suggest softer economic activity, but monetary policy is not instantaneous," said Kerry Craig, Global Market Strategist, J.P. Morgan Asset Management.

"This means that the RBA is willing to wait to see whether the 50 bps of rate cuts this year will deliver a pick-up in growth in the second half before taking further action."