By Stella Qiu

SYDNEY (Reuters) - Australia's central bank held interest rates steady on Tuesday for a fourth month, but again warned that further tightening might be needed to bring inflation to heel in a "reasonable timeframe".

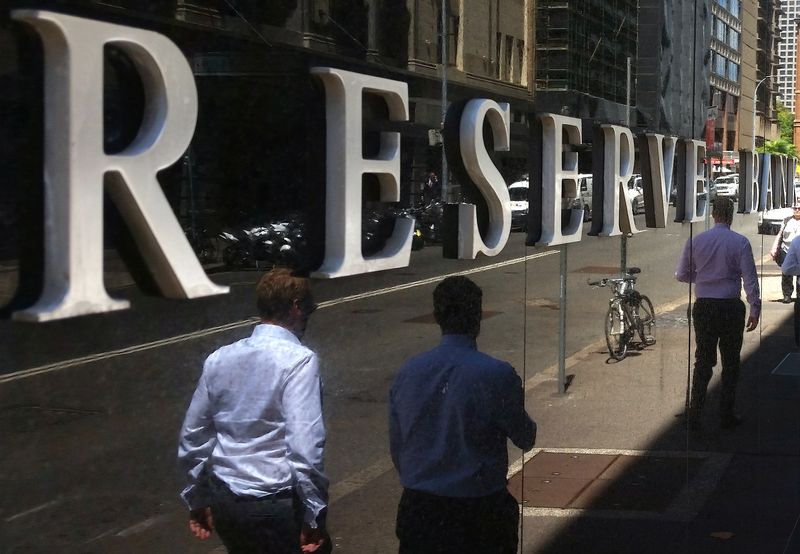

Wrapping up its October policy meeting, the first chaired by Governor Michele Bullock, the Reserve Bank of Australia (RBA) held rates at an 11-year high of 4.10%, and said recent data were consistent with inflation returning to its 2–3 percent target over time with output and employment still growing.

Markets and economists had wagered on a steady outcome after a batch of economic data - including inflation, retail sales and job vacancies - did not materially change the interest rate outlook.

Some economists, however, have pencilled in a rate hike in November depending on the result of the third-quarter inflation report.

The Australian dollar barely budged on the steady outcome and was last at $0.6343, having slid 0.3% earlier in the day. Three year bond futures also held earlier losses, down 4 ticks at 95.87.

"This will provide further time to assess the impact of the increase in interest rates to date and the economic outlook," Bullock, who took over from Philip Lowe last month, said in a statement almost identical to previous meetings.

"Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will continue to depend upon the data and the evolving assessment of risks."

Over the month, inflation ticked up as expected due to petrol prices, job vacancies tumbled from historically high levels and consumer spending stayed subdued, suggesting the rate hikes so far are working to cool demand in the economy.

A surge in global bond yields is also tightening financial conditions, lessening the pressure on central banks to hike further.

The RBA has jacked up interest rates by a whopping 400 basis points since May last year, and the latest assessment is that it sees a credible path where inflation can return to the bank's 2-3% target band in late 2025 with the cash rate at 4.1%.