By Stella Qiu

SYDNEY (Reuters) -The head of Australia's central bank on Thursday said the strong third-quarter inflation report was around policymakers' expectations, and they were still considering whether it would warrant a rate rise.

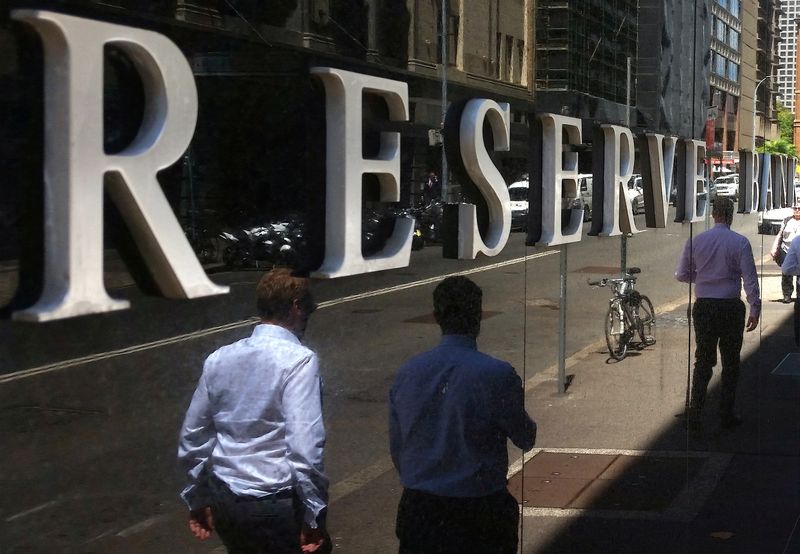

Reserve Bank of Australia Governor Michele Bullock warned earlier this week that the central bank will not hesitate to raise interest rates further if there is a "material" upward revision to the outlook.

"We are still analysing the numbers ... We have to look at whether or not it's material enough to change our views on monetary policy," Bullock said on Thursday in her first appearance before lawmakers since assuming the role of governor in mid-September.

"Given the information that have come in since then, particularly the monthly CPI indicator, we thought it was going to be about where it came out."

The Australian dollar dipped to a fresh 11-month low of $0.6285, and futures rose slightly but still imply a 60% chance that the RBA would resume the tightening cycle in November after four rate pauses.

Bullock noted that goods inflation is coming down as desired, but services inflation is higher than what policymakers were comfortable with.

The third quarter inflation was higher than what the central bank had forecast in August, which raised concerns about whether the RBA can get inflation back to the target band of 2-3% in late 2025, an already protracted path compared with other major economies.

It will release its updated economic forecasts in early November.

"When we go through our process of looking at our forecasts after the most recent news, we will again be making a judgment about how long do we think we can stay outside of the band in thinking what our monetary policy should be," said Bullock.