By Wayne Cole

SYDNEY (Reuters) -Australia's Labor government will launch its first budget next week with warnings about global recession and tough spending choices at home, while still meeting the modest promises made to win election earlier this year.

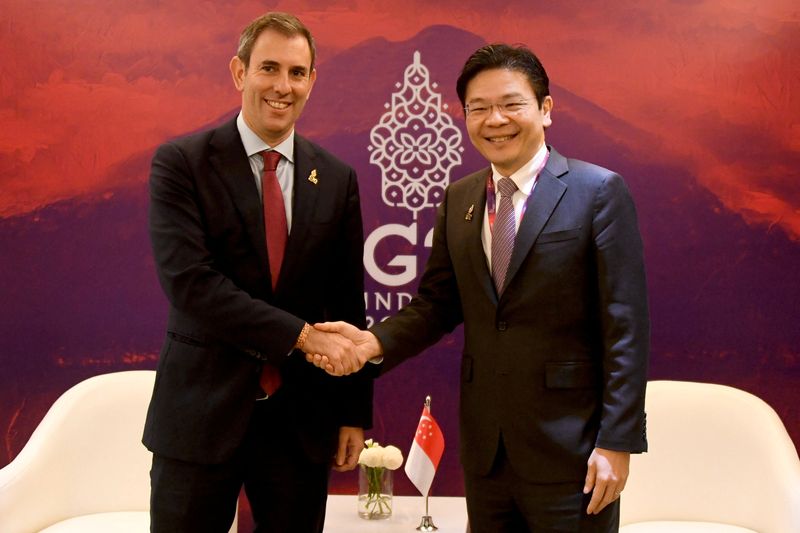

Keen to avoid any echo of the mayhem caused by Britain's recent mini-budget, Treasurer Jim Chalmers has put the accent on "responsible" for his effort, foreshadowing restraint on spending to support the Reserve Bank of Australia's (RBA) struggle against runaway inflation.

"The lesson for us is we do what's right, responsible, solid, sensible and suited to the times because the stakes are relatively high at a time when the global economy is a pretty uncertain place," Chalmers said in a briefing on Friday.

"So a premium for us is getting that balance right. I think we got things pretty nicely lined up between fiscal policy and monetary policy in the document I'll release on Tuesday night, and I hope markets think the same."

Investors seem reassured, so far, with no hint of the havoc that wrecked the UK gilt market.

Chalmers also said the previous Liberal National government had "booby trapped" the budget with more than A$6 billion ($3.7 billion) in unfunded spending that would have to be covered in the deficit due to be announced on Oct. 25.

Fortunately, that deficit will be much smaller than first feared thanks to high prices for many of Australia's major commodity exports and a surprisingly strong labour market that has seen unemployment reach 48-year lows at 3.4%.

As a result, the deficit for the year to June 2022 came in at A$32 billion, less than half the projection made back in March.

Analysts are tipping the 2022/23 deficit will range from A$25 billion to A$45 billion, or around 1-1.5% of gross domestic product and relatively frugal by international standards.

It is likely to widen a little from there as the government expects commodity prices to ease and spending pressures to mount, particularly on healthcare and childcare.

TRIPLE A

Natural disasters are also becoming a real headache, with flooding across the east coast this year costing billions in relief payments with more to come.

Chalmers also said on Friday the widespread floods would likely detract a quarter of a percentage point from economic growth in the December quarter, and add 0.1 percentage point to inflation in the December quarter and again in the March quarter.

He has also flagged steep downgrades to forecasts for global growth as central banks around the world hike interest rates. The RBA has lifted its rates by 250 basis points since May, boosting bond yields and the cost of government borrowing.

Indeed, Chalmers has said the fastest growing area of spending would be borrowing costs "on the trillion dollars of debt that we've inherited".

Gross debt is expected to peak around A$1.1 trillion, though again that is moderate by international standards. On the IMF measure, Australia's gross debt is around 57% of GDP, compared to 71% in Germany, 87% in Britain and 122% in the United States.

This is a major reason Australia is one of only eight nations that can boast a triple-A credit rating.

"For the years ahead, a budget deficit of 1.0%-1.5% of GDP will be an important part of fiscal policy working hand-in-hand with monetary policy to help the economy through the period of surging inflation and slower global economic growth," said Stephen Halmarick, chief economist at CBA.

"Small budget deficits will also help net debt decline as a share of GDP, adding comfort to Australia's AAA credit rating."

($1 = 1.6031 Australian dollars)