Investing.com - Markets are tense Wednesday due to two key events: the U.S. Consumer Price Index (CPI) for May and the interest rate decision by the U.S. Federal Reserve (Fed).

- How to invest on this crucial day? Don't hesitate! Try InvestingPro! Subscribe HERE AND NOW for less than 9 euros per month and get almost 40% off on a 1-year plan for a limited time!

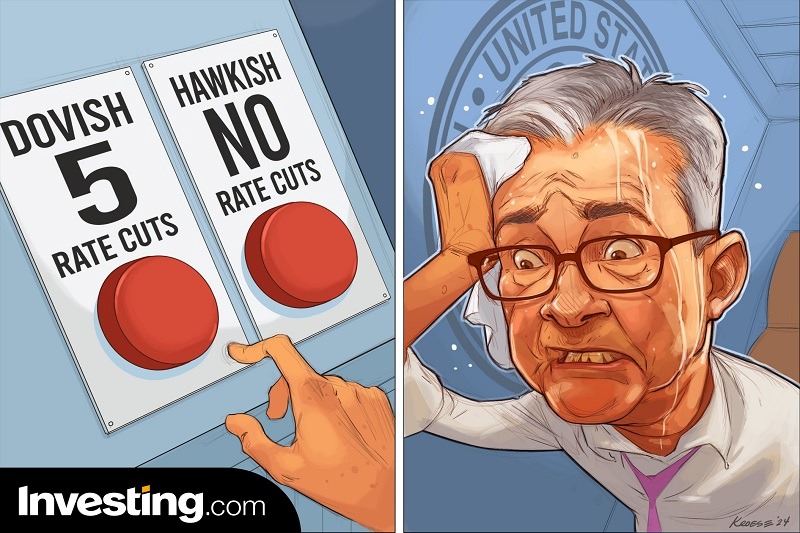

Experts are starting to consider the possibility that the Fed might significantly lower its expectations for rate cuts. Some even suggest that we might not see any rate cuts at all.

"To say there are mixed macro data in the U.S. economy is an understatement compared to what's being published: a good example is the ISM, which shows an intense slowdown in its manufacturing part (dropping from 49.2 to 48.7, below the expected 49.5), while its services version accelerated from 49.4 to 53.8, far exceeding the estimated 51. In other words, we are facing a clear dichotomy between the industrial and services sectors, implying slower future growth... but an economic powerhouse at present," explains Pedro del Pozo, financial investment director at Mutualidad.

"As if this weren't enough, the employment data was simply perplexing: on one hand, net job creation was spectacular, with 272,000 new jobs compared to the expected 180,000. In sum, a locomotive running at full steam... or perhaps not: Unemployment rose to 4.0%, while the participation rate fell, which is incongruous. In other words, we are seeing very strong tensions in the U.S. labor market, sending signals of genuine uncertainty," adds Del Pozo.

According to this expert, "also in the U.S., markets have taken these data in the worst possible way, with sharp drops in debt and more moderate declines in stocks, which see the possibility of rate cuts in 2024 fading. If cuts do occur - unless the unemployment and ISM manufacturing data decisively outdo their employment and services counterparts in the very short term - it would almost certainly be after the presidential elections on November 5."

"How far away do the possible March rate cuts seem, don't they?" asks Pedro del Pozo.

Europe

In Europe, most of the attention during the last ECB meeting was focused on the institution's new macro projections. "In truth, what we've seen is an exercise in adapting to new macroeconomic conditions, as a result of which the official core inflation forecasts have risen from 2.6% to 2.8% this year, and from 2.1% to 2.2% in 2025. In other words, the ECB estimates that it will not reach its CPI target until the end of next year or early 2026. Naturally, this means a new roadmap regarding the pace of interest rate cuts, as we mentioned at the beginning of the article," explains Del Pozo.

"This doesn't mean we won't see new actions in this direction, but they certainly won't be a continuous or immediate process. In reality, at least one more cut would be expected this year... but not much more, in light of these data. This is something the markets have immediately taken on board, once again showing yield increases in debt curves and a bit more volatility in stocks. If tensions in Europe regarding prices are the hot topic in the markets on the Old Continent (with the recent European Parliament elections results permitting)," adds the expert from Mutualidad.

"All this said, a couple of final thoughts are worth considering: the first is that, although much slower and more painful than initially expected, we are already immersed in a process of monetary normalization, of which the Eurozone rate cut has been the starting gun. It is true that we are in a less liquid, more compartmentalized, and therefore more inflationary world than seen in the past decade. But normalization, nonetheless," he notes.

"The second point is that this can be leveraged for investment. And we refer, once again, to fixed income as the main target, once again under tension in almost all segments of the curve. As for equities, everything will depend on how the economy evolves and the impact that higher rates for longer have on it. In that sense, prudence, at least in the short term," concludes Pedro del Pozo.

How to continue seizing market opportunities? Take advantage of the opportunity HERE AND NOW. Use the code INVESTINGPRO1 and get a 40% discount on your 1-year subscription. This will get you:

- ProPicks: stock portfolios managed by a mix of artificial intelligence and human expertise, with proven performance.

- ProTips: digestible information to simplify complex financial data into a few words.

- Fair Value and Health Score: two synthetic indicators based on financial data that provide an immediate view of each stock's potential and risk.

- Advanced stock screener: Search for the best stocks based on your expectations, considering hundreds of metrics and financial indicators.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can look for all the details.

- And many other services, not to mention those we plan to add soon!

Act fast and join the investment revolution! Get your OFFER HERE!