By Marcela Ayres, Bernardo Caram and Lisandra Paraguassu

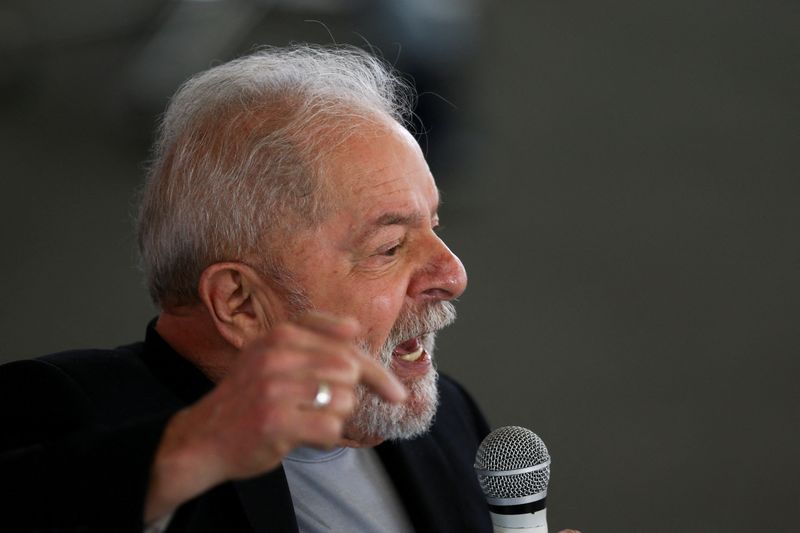

BRASILIA (Reuters) - Leading economists in and around Brazil's Workers Party are nearly united in scorn for a new law shielding the central bank from presidential influence – but there is an important voice of dissent in the party: ex-President Luiz Inacio Lula da Silva.

As Lula gears up for his presidential campaign this year, he has pointedly avoided naming a spokesman for economic proposals. That has made clear that Lula alone is the deciding voice on his economic agenda – and he has shown no qualms seeking common ground with centrists, even where it breaks with his left-wing party's consensus.

The early signs of moderation from the front-runner in this year's election have turned some investors bullish on Brazil, helping to draw nearly $10 billion in foreign flows to local markets and boosting the country's currency and stocks.

In interviews with a half dozen economists and ex-ministers advising Lula or his party's policy think tank, all made clear that they did not speak on the former president's behalf.

Nowhere was that clearer than in their criticism of a law passed last year to formalize the central bank's autonomy by giving its governor a term straddling presidential elections and removing the role from the government cabinet.

Five of the six economists interviewed by Reuters disparaged the law, warning that it tied the president's hands on macroeconomic policy. Lula himself criticized the idea a year ago, but he has since played down concerns.

"People take issue with the so-called independent central bank. Look, this central bank has to be committed to Brazil, not to me," Lula told journalists last month, adding that he was ready for a constructive dialogue with the current central bank president. "I see differences of opinion, but no obstacle."

Two other political advisors to Lula, speaking on condition of anonymity, ruled out any efforts to change the central bank law if Lula wins the October election, which polls show him carrying by a healthy margin.

Elsewhere, the consensus among advisors to Lula and the Workers Party has lined up more clearly with the economic agenda he has previewed publicly. All agreed on loosening fiscal rules to allow an expansion of public investments, social programs and 'green' growth initiatives, while scrapping the major privatizations proposed by current President Jair Bolsonaro.

'DEVELOPMENTALIST' DOUBTERS

Still, Brazil's left-leaning economists seem wary of relinquishing government control of monetary policy.

Pedro Rossi, a member of the Perseu Abramo Foundation (FPA) think tank created by the Workers Party and a professor at the State University of Campinas (Unicamp), a hotbed for the PT's "developmentalist" school of state-led economic policy, said the central bank must follow the president's lead.

"Monetary and fiscal policies cannot go against each other," argued Esther Dweck, an economics professor at the Federal University of Rio de Janeiro and former budget secretary in the most recent PT government.

Luiz Gonzago Belluzzo, a Unicamp economics professor who has advised Lula for decades, argued government policy should be able to use some $360 billion in foreign reserves held by the central bank in order to more forcefully stabilize the country's exchange rate.

His criticism echoed that of former Finance Minister Guido Mantega, who engaged in what he called "currency wars" while serving under both Lula and his PT successor Dilma Rousseff, battling against what he considered an overvalued exchange rate.

Mantega told Reuters the current central bank's hands-off approach to Brazil's currency market had led to excessive depreciation, contributing to Brazil's double-digit inflation.

The law establishing central bank autonomy last year included a mandate to stabilize economic growth and encourage full employment. But Eduardo Moreira, a founder of asset manager Brasil Plural who has advised Lula on economics, argued in an interview that the newly independent central bank had not changed its policy or communication to reflect that new mandate.

Nelson Barbosa, a professor at the Getulio Vargas Foundation who served as finance minister under Rousseff, was the only economist surveyed who saw no problem with the central bank's new formal independence, arguing it had little effect on economic policy.

"I don't think it will be a big problem with the eventual return of Lula," he said.