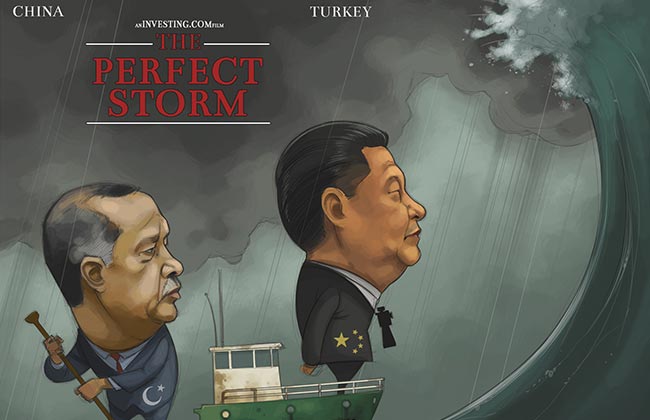

Investing.com - Jitters over a deepening currency crisis in Turkey combined with ongoing trade tension between China and the United States kept global financial markets on their toes this week.

The Turkish lira dropped to an all-time low of 7.1289 on Monday amid growing concern over a deepening diplomatic rift with the U.S. over Ankara's detention of an American pastor, whom Turkish authorities accuse of supporting a failed coup attempt in 2016.

While the lira has since pulled back from record low levels - finding support following reports on Wednesday that Qatar would invest $15 billion in Turkey - fear of full-blown crisis is far from over amid worries about President Tayyip Erdogan's growing influence over the economy, and his reluctance to raise interest rates despite rising inflation.

The lira is down almost 18% since the start of August. For 2018, it has lost approximately 50%.

Meanwhile, market focus stayed attuned to developments surrounding the brewing trade war between the U.S. and China.

China's Ministry of Commerce said on Thursday that it had received an invitation from the U.S. for talks to be held with U.S. Under Secretary of Treasury for International Affairs David Malpass.

The announcement by the Chinese commerce ministry of the planned meeting in late August comes after a lull in talks between the two sides.

The last official round of talks was in early June when U.S. Commerce Secretary Wilbur Ross met Chinese Vice Premier Liu He in Beijing.

Despite the positive developments Thursday, analysts remain cautious about the outlook for global financial markets, particularly those outside of the U.S. that have looked vulnerable whenever investors get nervous.

To see more of Investing.com’s weekly comics, visit: http://www.investing.com/analysis/comics