(Bloomberg) -- June is shaping up to be one of the best months for investors in Thailand as the nation’s currency, bonds and stocks outperform in Asia, but the market rally now faces formidable economic and political risks.

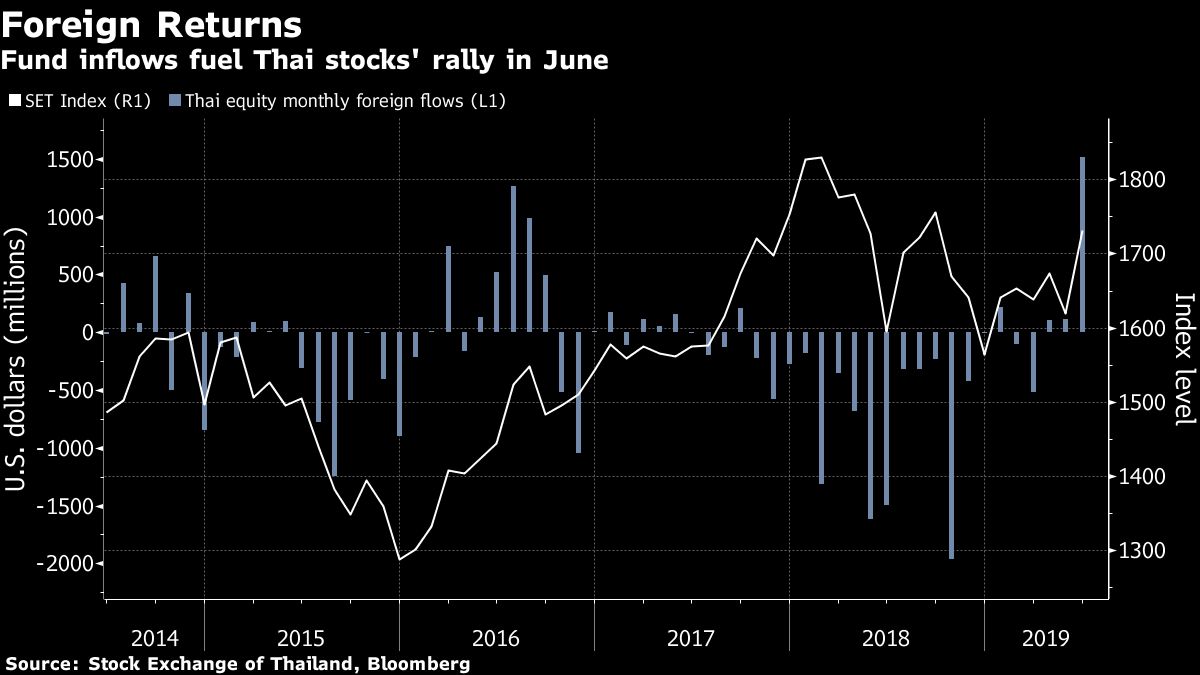

Thailand’s markets have been boosted by almost $4 billion of foreign inflows this month as the central bank held off from interest-rate cuts, helping support bonds and the currency. But even the Bank of Thailand has voiced concern over the baht’s strength and said it has intervened in the market, while economic growth prospects are worsening.

Read: Bank of Thailand Holds Key Rate as It Warns of Currency’s Gains

“Foreign funds are using equities and bonds as tools to speculate on the baht’s strength,” said Pornthep Jubandhu, head of the investment research group at SCB Asset Management Co., the nation’s biggest private money manager with $45 billion of assets. “This rally could be short-lived as fundamentals are very weak with the poor economic outlook, trade dispute and domestic politics.”

The Bank of Thailand this week lowered its growth forecast as the U.S.-China trade war hurt exports. Domestic political risk is also rising with the ruling coalition holding just a tenuous majority in the House of Representatives, and the opposition alliance set to fight what it sees as continued military control.

“There is little logic about the gain in domestic equities, currency and some other assets,” said Kavee Chukitkasem, deputy managing director at Kasikorn Securities Pcl. in Bangkok. “The economy is so weak with sluggish consumption, investment, exports and tourism. ”

Meanwhile, the “slim parliamentary majority will probably be the key risk to political stability," he said.

Expensive Stocks?

Thai stocks are again looking expensive, which means it’s a good time to book profits, Credit Suisse (SIX:CSGN) Group AG said this week, warning that ongoing performance will be weak. Morgan Stanley (NYSE:MS) on Wednesday downgraded Thai stocks to underweight.

The outlook comes after foreigners pumped a net $1.52 billion into domestic equities in June, the most in Asian markets. The key stock index now trades at 15.6 times 12-month forward earnings, compared with an average of a 14.9 multiple in the past three years.

Optimists

To be sure, there are those who remain optimistic like Binu George, an emerging-markets strategist at Grantham Mayo Van Otterloo & Co.

Thai stocks are benefiting massively from a booming tourism industry and the trade war that’s forcing companies to shift production from China, the California-based analyst said.

July has also typically be a good month for Thai stocks, with the benchmark index gaining in eight of the past 10 years.

The meeting this week between the leaders of the U.S. and China over trade will also help determine the market outlook. Thailand, seen as a haven among emerging markets, could see some outflows if the dispute is settled, according to Padermpob Songkroh, managing director of Yuanta Securities (Thailand) Co. in Bangkok.

“What we should pray for is that trade tensions will continue so foreign investors will continue to pour money into Thai stocks and bonds,” he said. “If the risk of tariffs is removed, international investors will move their money into other riskier assets or destinations, which offer higher return."