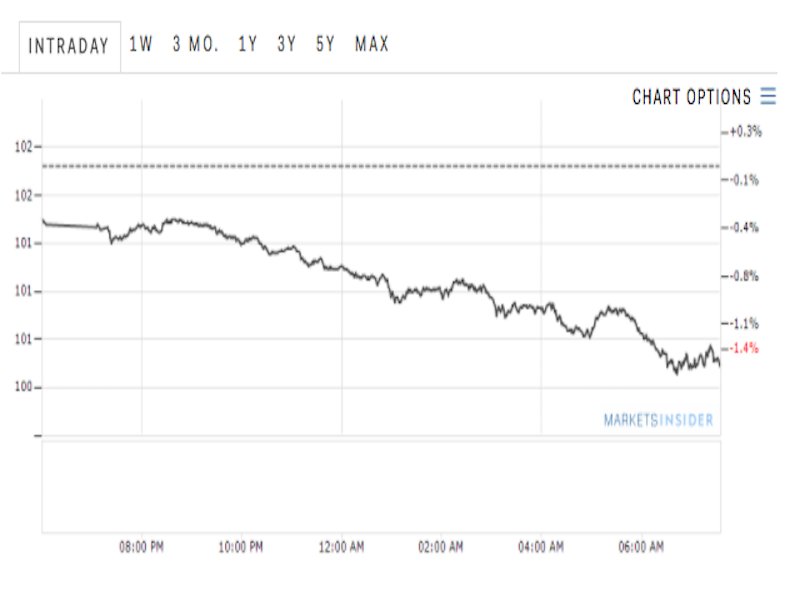

The dollar is tumbling.

The US dollar index was down by 1% at 100.51 as of 7:44 a.m. ET.

The index's drop follows two comments from President-elect Donald Trump in an interview with The Wall Street Journal.

Trump said the border-adjustment plan, a proposal that would tax imports and exempt exports, was "too complicated." Additionally, he said the dollar was "too strong."

"Our companies can't compete with them now because our currency is too strong. And it’s killing us," Trump told The Journal, referring to competition from China.

"The investment community, like Americans themselves, is grappling with how literal to take the seemingly visceral remarks," Marc Chandler, the global head of currency strategy at Brown Brothers Harriman, noted. "In the larger picture, of the numerous factors that impact foreign exchange rates, the wish and desires of officials do not often seem to be particularly salient."

"The current USD correction could continue for a few more days as positioning clears out, but we believe this will ultimately create opportunities for FX investors," a Morgan Stanley (NYSE:MS) team led by Hans W. Redeker argued. "Strong US data should continue to be the main source of support for USD, focused against low-yielding DM."

As for the rest of the world, here's the scoreboard as of 7:55 a.m. ET:

- The British pound is up by 2.3% at 1.2329 against the dollar following UK Prime Minister Theresa May's first major speech outlining the plan for Brexit. She confirmed that Britain was seeking a "hard Brexit" — i.e., it will leave the European single market. Separately, data from the Office for National Statistics showed consumer prices in the UK rose 1.6% in December, up from November's 1.2% print.

- The euro is higher by 0.8% at 1.0688 against the dollar. The latest reading for the German ZEW Economic Sentiment came in at 16.6 for January, below expectations of 18.3 but above the prior reading of 13.8.

- The Russian ruble is stronger by 1.1% at 59.1753 per dollar, while Brent crude oil, the international benchmark, is up by 1.2% at $56.53 a barrel.

- The Japanese yen is up 0.6% at 113.55 per dollar.

- The Mexican peso is stronger by 0.7% at 21.5846 per dollar.