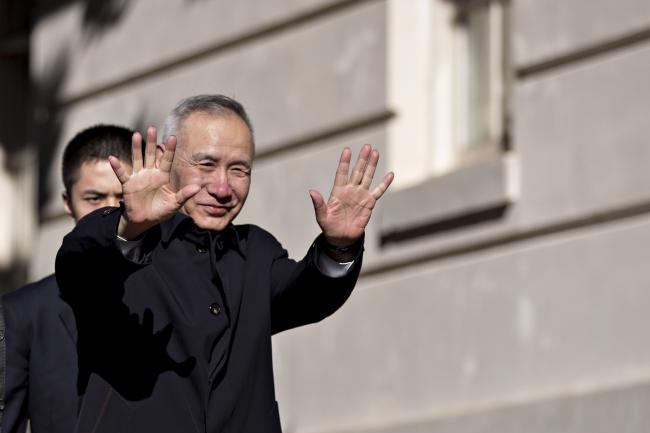

(Bloomberg) -- U.S. President Donald Trump will meet Chinese Vice Premier Liu He at the White House on Thursday, as negotiations over a trade deal between the world’s biggest economies enter what could be the final stages.

Talks are continuing in Washington where Liu held meetings with U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin on Wednesday. The goal over the next few days is to strike an agreement on the core issues so Trump and Chinese leader Xi Jinping can hold a ceremony to sign a deal.

Drafts of an agreement to end a nearly year-long trade war would give Beijing until 2025 to meet commitments on commodity purchases and allow American companies to wholly own enterprises in the Asian nation, according to three people familiar with the talks.

“Both sides do want an agreement but they want to make sure it’s the right deal for their respective domestic audience,” said Tai Hui, Asia-Pacific chief market strategist at JPMorgan (NYSE:JPM) Asset Management in Hong Kong.

Stocks in Asia were mixed in early Thursday trading after American equities edged up to a six-month high, as investors look for signs of progress. The offshore yuan held at 6.7173 per dollar.

As the talks resumed on Wednesday morning, Trump’s top economic adviser touted progress but cautioned that a final deal to end the trade war remained elusive. Negotiators are “making good headway,” White House economic adviser Larry Kudlow told reporters at an event in Washington. “But we’re not there and we hope this week to get closer,” he said.

U.S. and Chinese officials are still discussing when the two leaders could sit down to sign off on their trade deal. A meeting date between Trump and Xi could be announced as early as Thursday, people familiar with the plans said. After Xi’s team initially floated a formal state visit to Washington as an option, China has pushed back against a meeting on U.S. soil and wants to instead meet in a neutral third country, the people briefed on the plans said.

While White House officials have expressed cautious optimism in recent days about securing a deal in the near future, a U.S. decision to tentatively sell fighter jets to Taiwan may affect the outcome of this week’s talks as well as any Trump-Xi summit, one of the people said. Given the geopolitical sensitivities of such a sale, that issue would likely be raised only when the two leaders meet and is unlikely to be part of the trade negotiations led by Lighthizer.

Under the proposed agreement, China would commit by 2025 to buy more U.S. commodities, including soybeans and energy products, and allow 100 percent foreign ownership for American companies operating in China as a binding pledge that can trigger retaliation if left unfulfilled, according to the people, who asked not to be identified because the talks are private.

Other non-binding promises China has offered to implement by 2029 wouldn’t be tied to potential U.S. retaliation, they said, without elaborating.

The limited time frame raises questions about how much a deal would reshape the longer-term economic relationship, rather than simply serve as a political win for Trump that would last through a potential second term as the 2020 election campaign kicks off. While some progress is being made, resolving more contentious issues such as the forced transfer of technology is taking longer.

2020 Election

China’s Commerce Ministry didn’t immediately reply to faxed questions. The White House referred questions to USTR, which didn’t immediately reply to a request for comment.

The White House is particularly focused on Chinese purchases of American goods through the second quarter of 2020, in an effort to narrow the trade balance ahead of Trump’s re-election bid. For that reason, the U.S. is pushing for China to front-load a big chunk of the commodities purchases in the first two years the agreement is in place, people familiar with the situation said.

The merchandise-trade deficit with China hit a record $419.2 billion in 2018.

The two sides are still haggling over how to enforce the deal, which Lighthizer has said is the fundamental issue in the talks. In congressional testimony in February, Trump’s top trade negotiator said the U.S. wants the right to take unilateral, “proportional” action against China if it fails to abide by the rules. A person familiar with the text said China so far agreed only to consider avoiding retaliation if the U.S. took action against Beijing, but stopped short of a formal pledge to refrain from counter-punching.

One of the final issues is what will happen to the tariffs the two sides have imposed on about $360 billion of each other’s goods in the past nine months. Trump has suggested that at least some of the tariffs will stay in place, saying they are necessary “for a substantial period of time” to ensure Beijing keeps up its end of the bargain.

The text will also include benchmarks, likely set at 90 days and 180 days after signing, by which China is asked to fulfill key pledges, two of the people said, without giving further details.

(Updates with markets in fifth paragraph.)