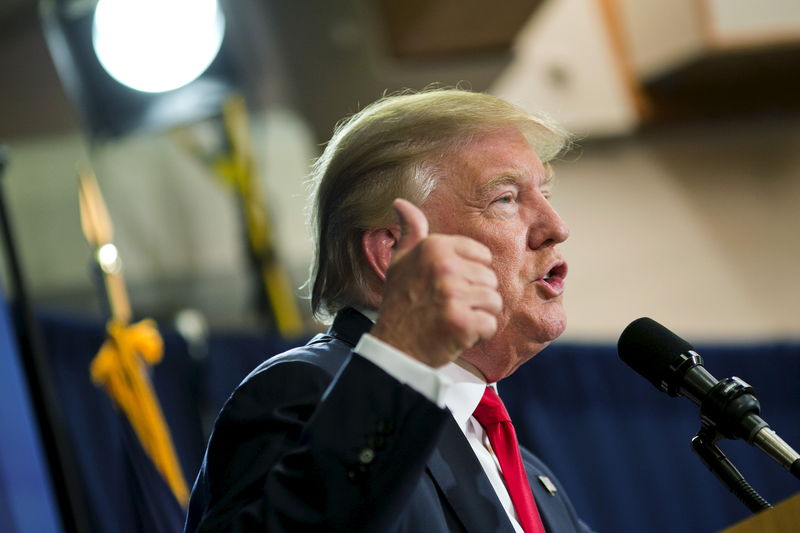

Investing.com – U.S. President Donald Trump is widely expected to provide further details on his policies, particularly on tax reform, in his State of the Union Address on Tuesday, but time may be running out for any changes to have an impact this year, according to Barclays (LON:BARC).

These analysts pointed out that there has been a lack of specifics on major policy items such as public investment or tax reform.

“While there have been some hints about the type of corporate income tax reform that the administration might deliver – a broadening of the base and cuts to the tax rates – markets are still waiting for the 2017 key draft fiscal budget,” they explained.

“We think that the presentation to Congress will be a good opportunity for the President to more clearly flesh out his policy priorities and goals, especially on trade, taxes, and public investment,” they added.

However, these experts warned that with Republican leaders continuing to stress immigration, Affordable Care Act (ACA) reform, and other priorities over fiscal policies, the risk of delay in tax and spending policies was rising.

“Time is clearly running out for enacting expansionary fiscal policies that might provide a boost to growth and inflation in 2017,” they warned.

These analysts noted that Treasury Secretary Steven Mnuchin indicated last week that his goal was to pass major tax reform legislation before Congress leaves for the August recess, but noted that the timeline was ambitious and could be delayed.

These experts suggested that the administration would need to shift gears from immigration and health care to tax and spending policies, if there was to be a chance for a boost to the economy in the current calendar year.

“Absent any re-prioritization of policy in the next few weeks, we believe investors should re-orient their view on tax reform to 2018,” they said.

“Our baseline remains a combination of anti-trade policies in the form of tariffs against Mexico and China and expansionary fiscal policy that provides a boost to economic activity later this year, but we must acknowledge that the probability of our baseline materializing has fallen in recent weeks,” they concluded.