The yuan closed little changed around 6.9508 against the greenback on Tuesday.

Looking forward into 2017, a Goldman Sachs (NYSE:GS) macro research team wrote in a note to clients that their yuan view has become more negative, which poses a possible risk to the stronger dollar and global stocks.

"We forecast a $/CNY fix of 7.00, 7.15 and 7.30 in 3, 6 and 12 months, respectively, and long $/CNY is one of our 2016 Top Trades," the team wrote. "The pace of capital outflows and the evolution of the fix warrant monitoring; in our view, as long as the fix simply offsets dollar strength and capital outflows are contained, global risk appetite should hold up."

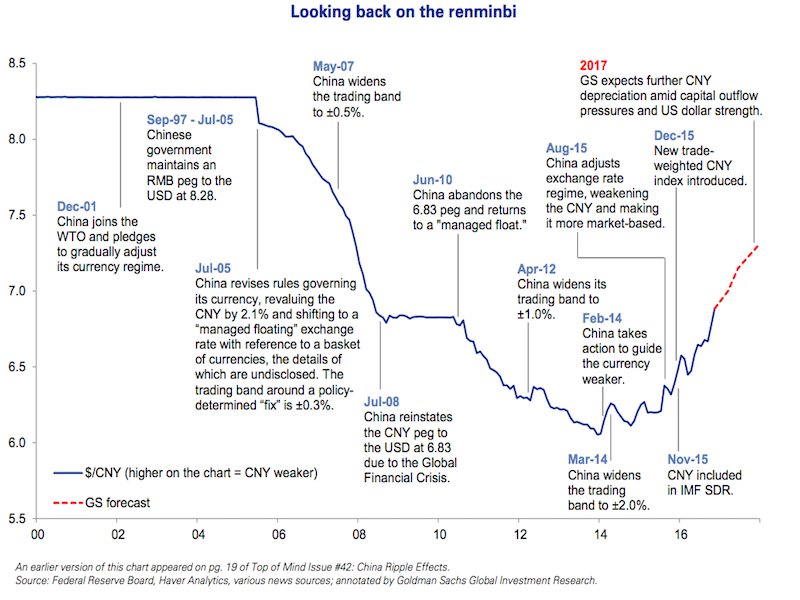

But before we head into 2017, it's worth taking a look at the yuan's moves over the last 16 years. In their note, the Goldman team also included a chart of a recent timeline of the renminbi versus the US dollar and the related events. Check it out.