(Bloomberg Opinion) -- When the Fed meets this week it is widely expected to raise its target for the federal funds rate by a quarter of a percentage point. President Donald Trump is not the least bit happy about this. This morning he offered what might be his sharpest rebuke yet of the Fed, and that’s saying quite a bit. His tweet had the flavor of a direct order:

Trump’s tweet brought immediate condemnation from economists and financial journalists concerned about Fed independence.

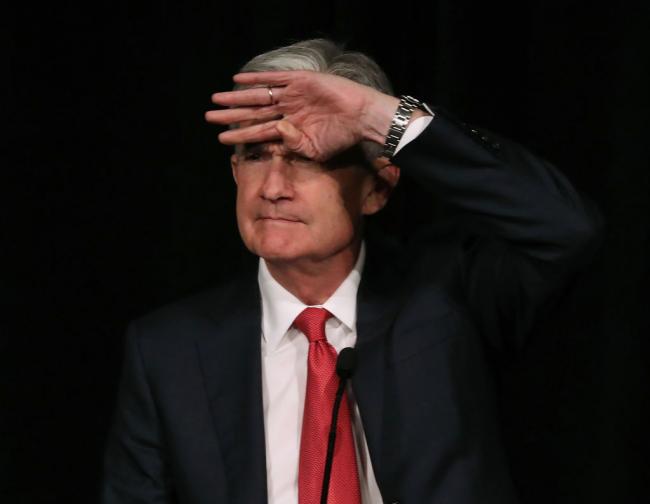

I am a bit more sanguine about Trump’s comments than many of my colleagues, and if anything have become more so over time. Federal Reserve Chairman Jerome Powell has done an excellent job both in reaching out to Congress and in emphasizing to the public that he reports to Congress, not the president. This isn’t exactly the job that Powell signed up for, but he is doing more than any chairman in recent memory to reinforce the Fed’s status as independent but accountable.

There is, of course, a rub. For all his bluster and inappropriateness, the president is not exactly wrong on the policy. Even though I am on the record as saying that the Fed should go ahead with its planned hike, on the theory that failing to do so would spook the markets into thinking that the Fed fears a recession, I am now having second thoughts.

My concern about the market’s reaction is waning. The market is clearly freaked out already. Crafting just the right communications strategy to deal with this is going to be difficult. The Fed needs to signal that it is ready to deal with any looming crisis, while at the same time indicate that it is willing to continue its normalization strategy if a full-blown crisis fails to materialize.

Balancing these two objectives might be easier if the Fed swapped more dovish policy for more hawkish rhetoric. Specifically, the Fed could hold interest rates steady at this week’s meeting, citing a surge in global uncertainty (brought on by Brexit, civil unrest in France, slowing demand in China and rapidly adjusting energy prices). It could then emphasize both in its statement and in Powell’s subsequent press conference that it is leaving open the possibility of raising rates in January.

If the global situation settles down, as the Fed hopes it does, then this will be a “delayed rate hike,” not a pause in the rate-hike cycle. If, on the other hand, risks continue to build, then the Fed may reconsider its overall policy. In taking this approach, the Fed can give businesses, consumers and investors some much-needed stability — without either caving to the president or freaking out the public.