On Sunday, Tesla (NASDAQ:TSLA) reported its vehicle deliveries for the second quarter.

Deliveries were slightly lower than for the first quarter: 14,370 vehicles in total, with 9,745 of those Model S sedans and 4,625 Model X SUVs.

Unlike most other automakers, Tesla doesn't report monthly sales. But to give investors, the media, and customers more insight into the company, it recently started putting out the quarterly totals.

In the first quarter, Tesla delivered 14,820 cars and confirmed its full-year guidance of 80,000 to 90,000 vehicles.

For the second quarter, Tesla missed on expectations, which had been running in the 15-17,000 range.

And if you do the math, that's a tally of only about 29,000 deliveries for the first half of 2016 — although Tesla did note that 5,150 vehicles out of the 18,345 that were produced are currently in the process of being shipped to customers and will be counted as sales in Q3.

Tesla also said that it expects to produce and deliver 50,000 vehicles in the second half of the year.

So yet again, Tesla full-year guidance is at risk. It will have to build as many vehicles from July to December as it did in all of 2015 to come in at the middle of its projections. And Tesla has never built 25,000 vehicles in a quarter.

Party like it's 2015 ... or 2014 ...

We've seen this movie before. Tesla is increasing quarterly production and deliveries year-over-year. Q1 2016 was almost 50% higher than the same quarter in 2015, and the bump from Q1 of 2016 to Q2 was 20%. Tesla is now selling another whole vehicle, the Model X SUV, although the production ramp has been beset with problems and its deliveries still lag Model S by a substantial margin.

But Tesla never looks to be in very good shape on guidance midyear, and everyone who follows the company just has to accept that it will go like hell and barely make the low end of that guidance.

I should point out that no other automaker has this problem. If Ford says it's going to build X-number of F-150 pickup trucks in a year, it builds X-number of pickups, barring a strike or major supply-chain disruption. If Ferrari (NYSE:RACE) says it's going to build 1,000 supercars, it builds 1,000 supercars.

Tesla needs to show substantial progress toward its now accelerated goal of delivering 500,000 vehicles annually by 2018, so for the past two years, it has consistently predicted near-doubling of sales, only to come in slightly under that.

But again, the math: Giving the company the benefit of the doubt, if it comes in at 90,000 this year, then doubles that for 2017 — 200,000, rounding up a bit — then 2018 falls 100,000 vehicles short of the half-million target.

Enter the Model 3

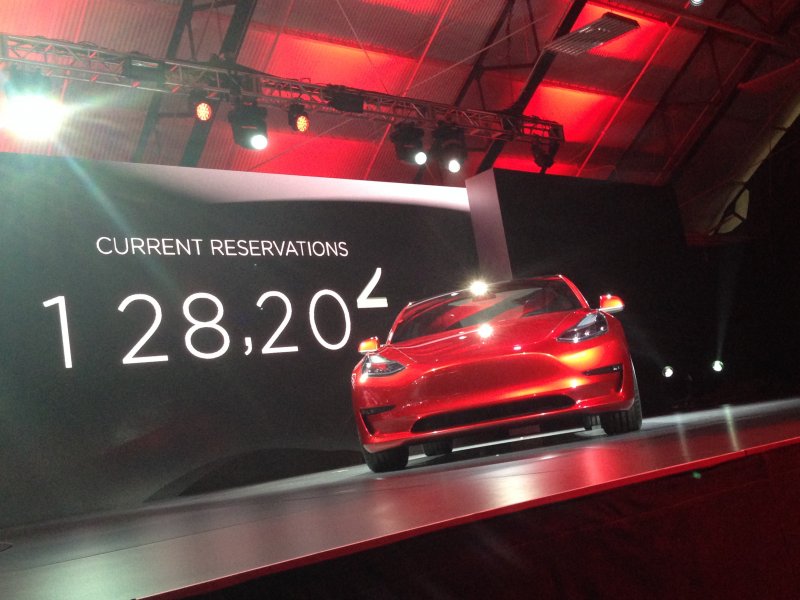

The solution is the new mass-market vehicle, the Model 3. With 375,000 pre-orders, fulfilling less than one-third gets Tesla across the finish line. (Assuming Model S and Model X demand doesn't tap out.)

Tesla has the theoretical manufacturing capacity to pull this off. Its factory in California, once a joint venture between GM and Toyota, can roll out 400,000 to 500,000 vehicles annually, at full capacity. (Tesla is currently running only two production lines.)

And the chatter in the auto industry is that Tesla is planning to make the Model 3 a much simpler car to bolt together, moving decisively away from the self-described "hubris" of the complicated Model X.

But still ...

A lot on its plate

Tesla doesn't really seem to have laser focus on Model 3 execution at the moment. In fact, the automaker appears to be bogged down in rectifying Model X problems, dealing with a large-scale Model S recall from last year, and attempting to buy SolarCity, the struggling solar-panel-leasing company that's run by Musk's cousin. (Musk is the chairman.)

The price could be as much as $3 billion (all stock), with over $3 billion of debt coming onto Tesla's balance sheet.

The deal is starting to make more sense than it did when it was announced, to dropped jaws, a week and a half ago.

Musk wants Tesla to be an "energy solutions" company, not just a carmaker. He wants to sell you everything you need — from a car, to solar panels to a big energy-storage battery — to go green and get off the traditional energy grid — or at least redefine your relationship with it.

But come on! Absorbing another company, at a time when Model 3 production has to get rapidly and effectively organized? SolarCity's deteriorating financials may have forced Musk's hand, but all things being equal, this isn't the distraction he needs if he's going to sleep on the Tesla factory floor and personally inspect the Model 3s as they roll off the line.

We should be surprised that Tesla's second-quarter numbers were a bit of a disappointment.

And the thing is, our disappointment isn't that big a deal. We know the pattern. And we understand what Tesla has in front of it: The same daunting challenge for the second half of 2016 as it did in 2015 and 2014.

At some point in the future, this pattern has to change, however. Mature car companies are able to manage and max out, profitably, their manufacturing capacity. The next two years are going to be all about Tesla figuring what its capacity actually is and then using it to the fullest.