By Marc Jones

LONDON (Reuters) - Following are five big themes likely to dominate thinking of investors and traders in the coming week and the Reuters stories related to them.

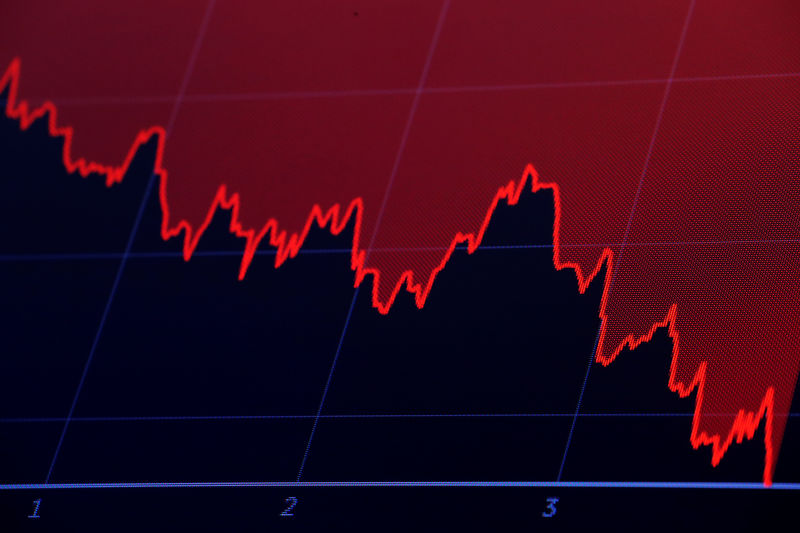

1/GRIN AND BEAR IT

Gulp! The savage global stock markets selloff means October could finish as the worst month for MSCI’s all-country index in at least seven years next week - with losses since January’s peaks now closing in on 15 percent.

The bear market has been extending its reach gradually around the world for months – from China to broader emerging markets to European autos and banks and almost 65 percent constituent stocks of MSCI’s all-country world index. Even the FANG+TM index of U.S. and world tech and internet stocks has joined the slump.

So what happens next? $7 trillion has been already wiped off of global stocks but there has been little hint of a bounce. Just as importantly the Federal Reserve and ECB show no sign of blinking in terms of tightening policy and China stimulus is yet to bite. History suggests that markets only tend to stop panicking when central banks start panicking.

The more optimistic, though, point out that Christmas is coming and Santa rallies often turn up a month early. Halloween is on Wednesday though so there is plenty of time for things to get scarier especially if Apple's results on Thursday turn out sour.

(Graphic: Markets turn grizzly in 2018 - https://tmsnrt.rs/2NXT4AB)

2/UK FUDGET

What happens with Brexit is still anyone's guess, but UK finance minister Philip Hammond will have to stand up on Monday and give his best approximation of a budget.

Britain's economy isn't exactly roaring so despite the promises of his boss Prime Minister Theresa May to end austerity, spreadsheet Phil as he is known in the UK press, won't be able to splash the cash -- or "show May the money" as Tom Cruise would yell it.

He will probably dangle the prospect of more spending if a smooth EU exit by March can be achieved, but the civil war raging in May and Hammond's ruling Conservative Party also means any talk of raising taxes to plug the UK's financing holes will be avoided for now at least.

Bank of England Governor Mark Carney faces a similar problem on Thursday. The central bank is expected to keep interest rates on hold and say it is sticking to its plan to raise them gradually. But that is also assuming Britain gets a Brexit deal and for both Hammond and Carney that is still a big unknown.

(Graphic: UK likely to lower borrowing forecast for 2018/19 - https://tmsnrt.rs/2ORwoHD)

3/KEEPING THE PEACE

It will be “kanwa no keizoku”, or easy policy on autopilot, when the Bank of Japan meets next week but it will come as little surprise given its goal of 2 percent inflation is slipping away again and the raging trade wars and market meltdowns.

It last tweaked policy in July, when it added a bit of flexibility to its zero percent target on 10-year Japanese government bond yields and this time there is chatter it might lay the groundwork to infuse some greater movement at the longer end of the bond curve which could be done by being less transparent with its monthly bond purchase plans.

Yet, the yen and JGBs have been some of the main refuges in the global markets storm and neither the BOJ nor investors want that to be disturbed. So this meeting may well be all about keeping the peace.

(Graphic: BOJ balance sheet vs JGBs - https://tmsnrt.rs/2ORlilA)

4/IN THE ZONE

Next week brings a heavy dump of euro zone data. On Tuesday there is the first reading of Q3 GDP and the main economic sentiment survey for the 19-country bloc and Wednesday is there is key inflation numbers. Together they will show just how much of an impact the trade war and stock market stresses are having on the economy.

ECB chief Mario Draghi showed little sign of panicking this week in face of the cocktail of hazards that have been building but if inflation misses forecasts of 2.2 percent for the headline number and 1.2 percent for the core print - which excludes volatile food and energy prices - it could give the central bank watchers a little more cause for concern.

Similarly quarterly GDP growth is expected to come in at around a 0.4 percent and any undershooting there probably won't be taken too well either. That applies to euro especially which is already down 4 percent in the last month against the dollar.

(Graphic: Euro zone economic sentiment and GDP - https://tmsnrt.rs/2OPqiHr)

5/WAGE GAUGE

Next week’s U.S. non-farm payrolls report is expected to show a rebound in job creation after the unexpected slowdown in September, with headline employment growth estimated at 190,000 in a Reuters poll. Unemployment looks set to hold near a 50-year low too but what could really grab attention is worker pay, which has long lagged the recovery in outright U.S. employment.

Economists in the Reuters poll estimate that wage growth could finally breach the 3 percent level on an annual basis for the first time since the end of the Great Recession of 2008-2009.

Any indication that wages are gaining traction will fed expectations for higher inflation and more U.S. interest rate hikes as a result. That could lift the dollar and U.S. bond yields as well as Donald Trump's attack level on the Federal Reserve.

(Graphic: U.S. wage growth - https://tmsnrt.rs/2OO48W0)