LONDON (Reuters) - 1/TRUMP AND G19

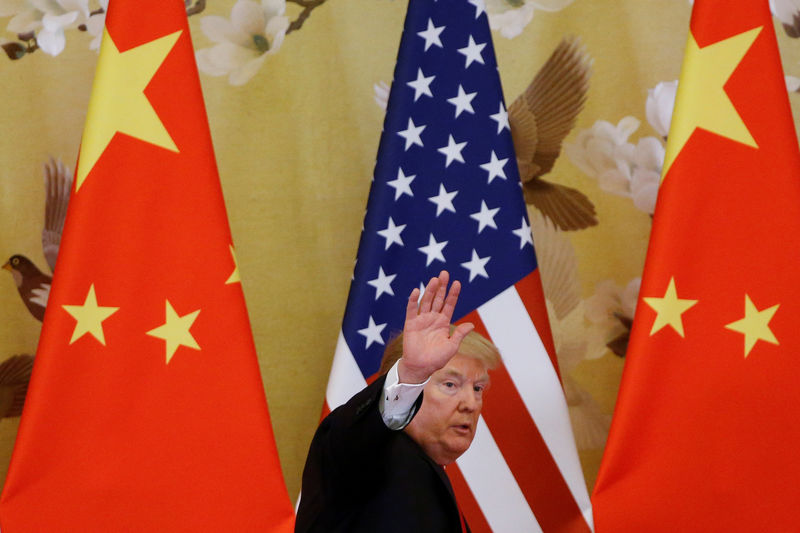

It's been a pretty tumultuous first-half and whether things calm down from here hinges on a June 28-29 summit of the G20 world powers, where Presidents Trump and Xi are expected to meet and hopefully resolve their differences on trade and tech. At stake is a decision on whether Washington slaps import tariffs on another $300 billion of Chinese goods, a scenario that Goldman Sachs (NYSE:GS) says could sink equity markets as much as 4%. It could also tip the balance between economic recovery and recession, as several markets, from shipping to copper, sound alarm bells.

Trump has bones to pick with other G20 leaders too. He will meet Turkish president Tayyip Erdogan who is risking U.S. sanctions on his country by placing an order for Russian-made S-400 missile defense system. India, Mexico, Canada and Germany have also all at different times incurred Trump's wrath over trade. Most recently he complained about the "devalued" euro which he said gave European exporters an unfair edge.

With more and more central banks pivoting towards policy easing, the issue of exchange rates looms large. Fears are that another currency war will further strain ties between nations. Japan says it will voice concern if currency moves elsewhere "deviate from economic fundamentals". But having just signalled readiness to ramp up stimulus, it too could find itself on the receiving end of Trump's anger.

Currency and trade wars aside, an actual war might be on the horizon after Trump allegedly ordered a missile strike on Iran, before rescinding it. Recent oil tanker attacks in the Gulf, blamed by Trump on Iran, also will be in focus.

2/REALLY FED UP

Having struggled for years to meet a 2% inflation target - excluding food and energy costs - the U.S. Federal Reserve might be forgiven for feeling a bit frustrated. In what went slightly unnoticed amid all the rate-cut focus at the last Fed meeting, policymakers again changed price growth forecasts -- downward.

The median projection for year-end core personal consumption expenditures (core PCE - the Fed's main gauge), was taken down to 1.8% versus 2% in the March forecasts. Headline PCE expectations dropped to 1.5%, the weakest projection since 2016.

May's core PCE reading, due June 28, is forecast to be steady at 1.6%. But watch for revisions to the April print. The previous reading was on target, but the March level was revised lower, indicating yet more ground lost in the battle to thwart disinflation.

It's unsurprising therefore that eight of 17 Federal Open Market Committee members see a lower Fed funds rate by end-2019.

3/SHOW ME THE INFLATION

Inflation week is coming up in the euro zone too and it will tell whether ECB chief Mario Draghi was right to fire his warning shot that more monetary easing would come unless prices started rising faster.

So far, years of stimulus and record-low rates have failed to work their magic and inflation has undershot the ECB's near 2% target since 2013. The rate was 1.2% in May. The bank is worried but it is a dilemma shared by policymakers in many countries, not least the United States and Japan.

German and Spanish inflation data is out Thursday. French numbers on Friday are released just ahead of the "flash" euro zone reading for June.

But Draghi's words have made a mark. A closely-tracked key market inflation gauge -- the five-year, five-year break even forward -- has shot up to 1.3%, having languished at record lows at around 1.12% ahead of Tuesday's speech.

Economists say "real economy" indicators, wages, for instance, paint a less pessimistic inflation outlook, raising questions about whether Draghi's reaction to market-based inflation measures is warranted. One more reason to watch next week's inflation data closely.

4/FOLLOW ME, FOLLOW YOU

Cutting interest rates, or at least flagging rate cut possibilities, is in vogue at the moment. And as often happens, the path trodden by the Fed, ECB and Bank of Japan is being followed also by emerging markets.

Central banks in India and Russia have already embarked on policy easing, Indonesia and Philippines have signalled cuts ahead. The spotlight shifts to Mexico, Hungary, Czech Republic and Thailand which have meetings scheduled in coming days.

Markets will be interested in what message is signalled by the Czechs. They have been raising interest rates but some policymakers have hinted there's no need for further tightening.

Mexico is reeling from a Fitch ratings downgrade and an outlook cut from Moody's and is unlikely make any moves until after the Fed. Hungary meanwhile is expected to put off any rate-tightening plans in response to the ECB's dovish pivot.

5/CAN WE HAVE A SUMMER LULL, PLEASE?

It's been an eventful year so far. Trade tensions have flared and calmed, then flared again. Mexico found itself replacing China as the lightning rod for trade tensions with Washington, only for the focus to shift back to Beijing.

Many central banks have made dramatic dovish pivots, re-igniting market rallies. These were doused every now and then by glum growth data that sent investors piling back into safe-haven and defensive bets, only to venture back into riskier waters. Add to the mix the tensions between Washington and Iran.

But Wall Street, at record highs, may be paying more attention to the Fed. Clearly, investors are divided on how this will play out: Safe havens gold and government bonds have rewarded investors with roughly 8% returns year-to-date. But higher-risk, growth plays did well too; emerging local currency debt for instance delivered 8% while the S&P500, Chinese stocks and Brent crude are up 20% on the year. Oil however has lost ground in the second quarter, hinting that worries over growth may be starting to gain the upper hand.

So bond markets are flagging a slowdown; equities suggest the opposite. We may find out in the next half-year which of them got it right.