BOSTON (Reuters) - The Federal Reserve will likely raise interest rates this year before markets currently expect since risks to the U.S. economy from abroad are fading, a top Fed official said on Monday.

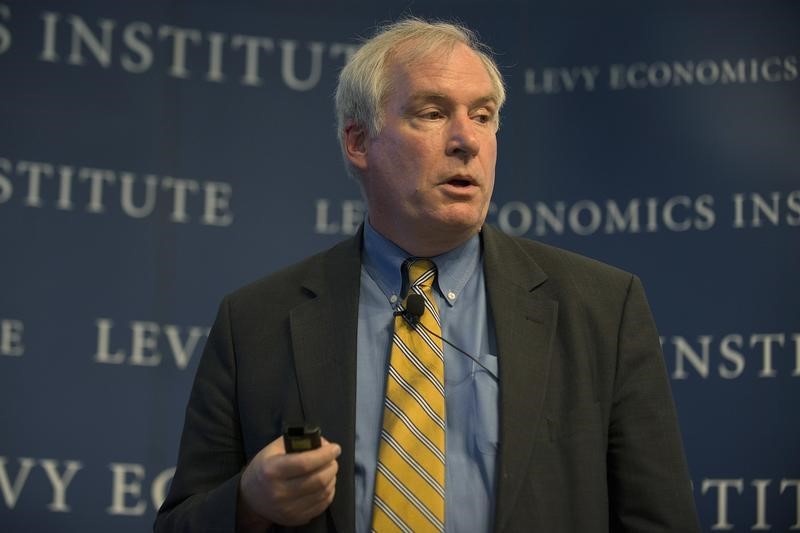

In a confident-sounding speech for a typically dovish U.S. central banker, Boston Fed President Eric Rosengren said it was "surprising" that futures markets currently imply one or zero rate hikes this year, a prediction he said could prove "too pessimistic."

The central bank raised rates for the first time in a decade in December but stood pat at a March policy meeting due to an overseas slowdown and early-year market volatility. After a cautious speech by Fed Chair Janet Yellen last week, Fed fund futures markets expect the next move to come in September.

"Risks seem to be abating that problems from abroad would be severe enough to disrupt the U.S. recovery (while) market volatility has fallen," said Rosengren, a voter on policy this year.

"The U.S. has weathered foreign shocks quite well ... and I believe it will likely be appropriate to resume the path of gradual tightening sooner than is implied by financial-market futures," as long as the recovery continues, he said.

Rosengren, addressing a Boston Fed conference on cyber security, did not mention the recent heist of $81 million from the Bangladesh central bank's account at the New York Fed.

In prepared remarks, he said "the ever-changing nature of the risk" means "cyber defense is an area where continued vigilance and continuous improvement are required" by both private banks and the Fed itself.