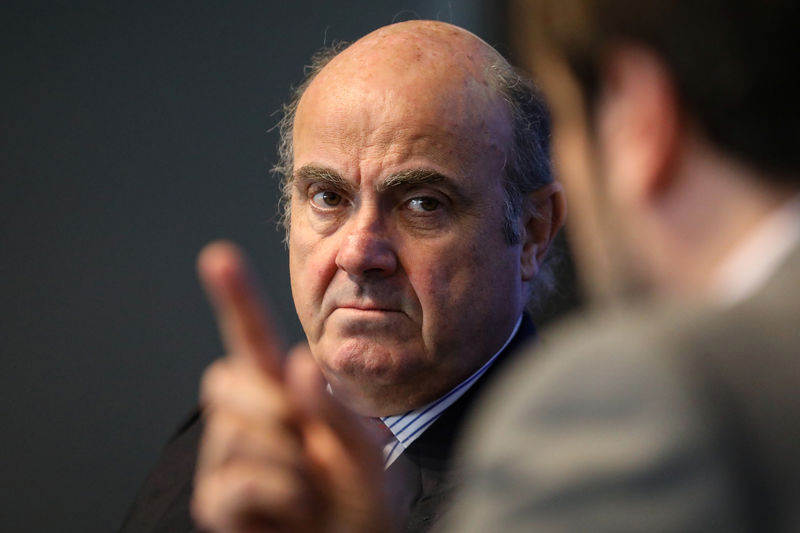

BERLIN (Reuters) - Risks are tilted to the downside and if they start to materialize, the European Central Bank will take action, ECB Vice President Luis de Guindos said on Wednesday, adding that the central bank could choose a mixture of actions to restore inflation.

ECB President Mario Draghi said on Tuesday that the ECB would ease policy again if inflation fails to accelerate, signaling one of the biggest policy reversals of his eight-year tenure and provoking the ire of U.S. President Donald Trump.

"We have a wide range of instruments available: We have forward guidance, we have TLTRO (targeted longer-term refinancing operations), we have the reinvestment of the maturities of our balance sheets — so there is an ample, you know, range of instruments that we could use, and QE (quantitative easing) is part of them," de Guindos told CNBC.