By Ann Saphir and Howard Schneider

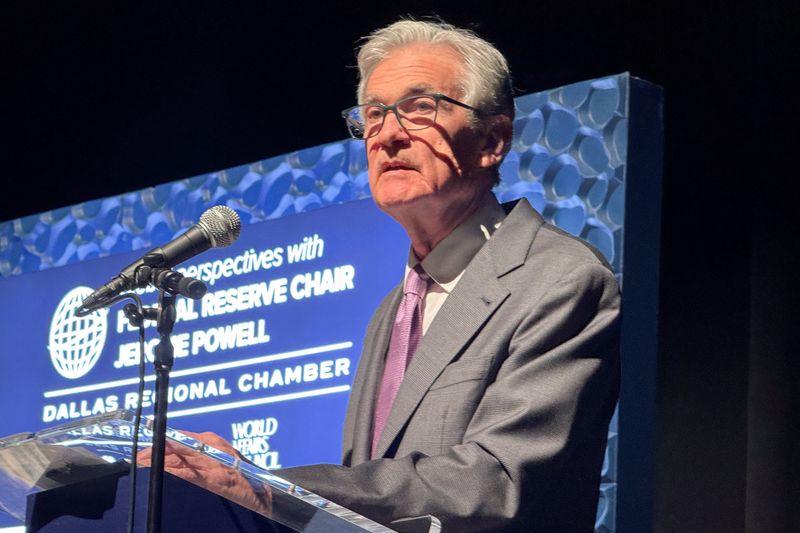

DALLAS (Reuters) -Ongoing economic growth, a solid job market, and inflation that remains above its 2% target mean the Federal Reserve does not need to rush to lower interest rates, Fed Chair Jerome Powell said on Thursday in remarks that may point to borrowing costs remaining higher for longer for households and businesses alike.Powell affirmed that he and his fellow policymakers still consider inflation to be "on a sustainable path to 2%" that will allow the U.S. central bank to move monetary policy "over time to a more neutral setting" that isn't meant to slow the economy.

But what that neutral rate might be in the current environment and how quickly the Fed might try to reach it all remain up in the air, particularly as central bankers assess both the ongoing strength of the economy and the impact the incoming Trump administration's policies, from higher tariffs to less immigrant labor, may have on economic growth and inflation.

Powell largely deflected questions about how new tariffs on imports or running the economy with fewer workers might alter the path of inflation the central bank has been trying to lower.

"We can do the arithmetic. If the are fewer workers there'll be less work done," Powell said, before adding "this is getting me into political issues that I really want to stay as far away from as I possibly can."

As of now, he said the economy was sending no distress signal that might prompt the Fed to accelerate rate cuts, and to the contrary "if the data let us go a little slower, that seems a smart thing to do."

"The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully," Powell said in prepared remarks delivered at a Dallas Fed event.

Fed officials and investors are taking stock of how continued U.S. economic strength and the uncertainty around the economic agenda of President-elect Donald Trump's administration, particularly regarding tax cuts, tariffs and an immigration crackdown, may affect economic growth and inflation.

After Powell's prepared remarks yields on shorter-term Treasury bonds rose, and traders pared bets about how far the Fed might cut rates in this cycle. The central bank cuts its benchmark overnight right to a 4.5% to 4.75% range at a meeting last week. As of September officials saw the rate dropping as far as 2.9% in 2026, but investors now see it remaining as high as 3.9%.

"We still think the FOMC is likely to cut at December but think today’s speech opens the door to dialing down the pace of easing as soon as January," wrote JP Morgan chief U.S. economist Michael Feroli.

NO OBVIOUS ANSWER

During a question-and-answer session, Powell said that while Fed staff may begin puzzling through the possible impact of tariffs and other campaign proposals from Trump, it will take time to understand, and won't become clear until new laws or administrative edicts are approved or issued.

"The answer is not obvious until we see the actual policies," Powell said. "I don't want to speculate...We are still months away from a new administration."

Still, he noted that economic conditions are different now than when Trump began his first term eight years ago, when there was lower inflation, lower growth and lower productivity.

A recent surge in immigration, for example, "made for a bigger economy" at a time of post-pandemic labor shortage, Powell said.

More broadly, following an election last week that may have turned on voter perceptions of the nation's economic ills, Powell said the current situation was actually "remarkably good."

The economy's strengths include a still-low 4.1% unemployment rate, growth at what Powell called a "stout" 2.5% annual pace that remains above Fed estimates of its underlying potential, consumer spending driven by rising disposable income, and growing business investment.

Yet key measures of inflation remain above target.

The personal consumption expenditures price index for October has not been released yet, but Powell said recent data that feeds into it indicates the PCE excluding food and energy costs rose at a 2.8% rate last month - which would mark a fourth consecutive month in which progress on inflation by that measure has stalled.

The Fed uses the headline PCE reading to set its 2% inflation target - Powell said that figure likely was around 2.3% in October - while the "core" measure is considered a guide to the direction of underlying inflation.

Traders still expect the Fed to cut interest rates by another quarter of a percentage point at its Dec. 17-18 meeting, and Powell said the central bank still has faith in continued disinflation.

But policymakers also remain on guard.

Major aspects of inflation "have returned to rates closer to those consistent with our goals ... We are watching carefully to be sure that they do ... Inflation is running much closer to our 2% longer-run goal, but it is not there yet," he said.